9 Best Forex Brokers in Kenya With Mpesa

Searching for the best forex brokers in Kenya with Mpesa? Look no further! Our expert guide reveals the top choices for fast, secure, and convenient forex trading.

Table Contents

There’s a world of opportunity in the foreign exchange (forex) market, but navigating it can be tricky without the right broker by your side. As a Kenyan trader, you need a broker that not only provides top-notch trading services but also caters specifically to your needs by accepting convenient Mpesa payments.

But with so many forex brokers touting their platforms, how do you separate the wheat from the chaff to find the truly best forex brokers in Kenya with Mpesa that suit your trading style?

We’ve rigorously analyzed numerous forex brokers to find the ones that deliver exceptional value to Kenyan traders through low fees, tight spreads, a selection of quality trading platforms and tools, as well as seamless Mpesa integration.

In this definitive guide, you’ll discover the 10 highest-rated forex brokers that accept Mpesa in Kenya right now.

9 Best Forex Brokers in Kenya With Mpesa

Show Summary

Here’s a list of the 9 best forex brokers in Kenya with Mpesa in 2024:

- XM: Overall best forex broker with Mpesa

- Exness: Best for beginners

- HFM: Best Copy Trading Forex Broker

- AvaTrade: Most Innovative Mpesa forex broker

- Pepperstone: Best ECN Forex Broker with Mpesa

- FBS: Best low minimum deposit

- JustMarkets: Best for instant deposits and withdrawals

- FxPesa: Best local forex broker

- LiteFinance: Best for crypto trading

When choosing a forex broker that accepts M-Pesa in Kenya, key factors to consider include regulation status, fees on M-Pesa transactions, minimum deposits, spreads, trading platforms offered and beginner friendliness.

Here’s a list of the 9 best forex brokers in Kenya with Mpesa in 2024:

- XM: Overall best forex broker with Mpesa

- Exness: Best for beginners

- HFM: Best Copy Trading Forex Broker

- AvaTrade: Most Innovative Mpesa forex broker

- Pepperstone: Best ECN Forex Broker with Mpesa

- FBS: Best low minimum deposit

- JustMarkets: Best for instant deposits and withdrawals

- FxPesa: Best local forex broker

- LiteFinance: Best for crypto trading

When choosing a forex broker that accepts M-Pesa in Kenya, key factors to consider include regulation status, fees on M-Pesa transactions, minimum deposits, spreads, trading platforms offered and beginner friendliness.

[table id=14 / responsive=scroll]

XM - Best Overall Forex Broker That Accepts Mpesa in Kenya

Editor Rating 4.9 ________ 4.49/5 XM Review [table id=15 /]

Editor Rating 4.9 ________ 4.49/5 XM Review [table id=15 /]

XM is a top choice for Kenyan forex traders using Mpesa due to its instant deposits, fast withdrawals, beginner-friendly platform, and commitment to trustworthiness and security.

While there are some minor drawbacks, such as the lack of phone support in Kenya, the overall benefits of trading with XM make it a standout option for those looking to succeed in the forex market using Mpesa.

Visit XM Official Website Why Choose XM?#### Click Here to Read the Detailed Review

XM is a well-regulated forex broker that has gained popularity among Kenyan traders for its seamless integration with Mpesa.

XM offers instant Mpesa deposits, ensuring that you can start trading without any delays. In addition, withdrawing profits from XM back into Mpesa is a smooth and fast process. You won’t have to wait the typical 3-5 days for bank transfers – withdrawals via Mpesa are usually processed within 24 hours by XM.

Furthermore, XM has strong security measures in place to keep traders’ funds safe when depositing and withdrawing via Mpesa. They utilize secure encryption technology and adhere to strict regulatory standards on segregating client funds. This gives traders confidence that their money is protected.

XM offers a wide range of trading platforms, including the popular MetaTrader 4 and MetaTrader 5, which provide advanced trading tools and features.

These platforms are available for various devices, including Windows, Mac, iPhone, iPad, and Android, allowing traders to access their accounts and trade from anywhere.

The broker also provides a comprehensive educational and research offering, including webinars, video tutorials, and market analysis, which can help beginner forex traders improve their skills and make informed decisions.

XM Pros

- Instant Deposits and Fast Withdrawals

- No Transaction Fees on deposits and withdrawals

- High Leverage up to 888:1

- Regulated by authoritative regulators in multiple jurisdictions

XM Cons

- Operates under a market maker license

- Higher spreads on beginner accounts

XM is a well-regulated forex broker that has gained popularity among Kenyan traders for its seamless integration with Mpesa.

XM offers instant Mpesa deposits, ensuring that you can start trading without any delays. In addition, withdrawing profits from XM back into Mpesa is a smooth and fast process. You won’t have to wait the typical 3-5 days for bank transfers - withdrawals via Mpesa are usually processed within 24 hours by XM.

Furthermore, XM has strong security measures in place to keep traders’ funds safe when depositing and withdrawing via Mpesa. They utilize secure encryption technology and adhere to strict regulatory standards on segregating client funds. This gives traders confidence that their money is protected.

XM offers a wide range of trading platforms, including the popular MetaTrader 4 and MetaTrader 5, which provide advanced trading tools and features.

These platforms are available for various devices, including Windows, Mac, iPhone, iPad, and Android, allowing traders to access their accounts and trade from anywhere.

The broker also provides a comprehensive educational and research offering, including webinars, video tutorials, and market analysis, which can help beginner forex traders improve their skills and make informed decisions.

XM Pros

- Instant Deposits and Fast Withdrawals

- No Transaction Fees on deposits and withdrawals

- High Leverage up to 888:1

- Regulated by authoritative regulators in multiple jurisdictions

XM Cons

- Operates under a market maker license

- Higher spreads on beginner accounts

Exness

Editor Rating 4.8 ________ 4.8/5 Exness Kenya Review [table id=7 /]

Editor Rating 4.8 ________ 4.8/5 Exness Kenya Review [table id=7 /]

Exness is regulated by the Capital Markets Authority (CMA) in Kenya, along with other top brokers like HF Markets, FXPesa, and Pepperstone.

A key advantage of Exness is that it accepts Mpesa, which allows fast and easy deposits/withdrawals for Kenyan traders. Other funding options include cards, bank transfer, e-wallets, and cryptocurrency.

Visit Exness Official Website Why Choose Exness?#### Detailed Exness Review

Founded in 2008, Exness has grown to become a leading online forex and CFD broker with a strong focus on technology and innovation.

Apart from being a CMA-regulated forex broker, Exness holds multiple other licenses from renowned regulatory bodies like the FCA, CySEC, FSCA, and FSA. This ensures oversight and compliance with strict standards to protect trader funds and data. Exness segregates client funds from its operational funds for added security.

Depositing money via Mpesa to Exness is straightforward. After logging into your Exness account, you select “M-Pesa” under the “Deposit” icon, fill in your M-Pesa details, and confirm the payment. The process is instant, and your deposit will be reflected in your Exness account within a few minutes.

Similarly, withdrawing money via M-Pesa from Exness is simple and quick. You just need to select “M-Pesa” under the “Withdrawal” icon in your Exness account. The minimum deposit and withdrawal amount via M-Pesa is USD 1, and there are no processing fees.

Exness Pros

- $1 Low minimum deposit

- No deposit or withdrawal fees

- You can open KES-denominated accounts, avoiding conversion fees.

- Dedicated customer support team for Kenyan traders

- Dedicated customer support team for Kenyan traders

- Education resources

XM Cons

- Operates under a market maker license

- Higher spreads on beginner accounts

Founded in 2008, Exness has grown to become a leading online forex and CFD broker with a strong focus on technology and innovation.

Apart from being a CMA-regulated forex broker, Exness holds multiple other licenses from renowned regulatory bodies like the FCA, CySEC, FSCA, and FSA. This ensures oversight and compliance with strict standards to protect trader funds and data. Exness segregates client funds from its operational funds for added security.

Depositing money via Mpesa to Exness is straightforward. After logging into your Exness account, you select “M-Pesa” under the “Deposit” icon, fill in your M-Pesa details, and confirm the payment. The process is instant, and your deposit will be reflected in your Exness account within a few minutes.

Similarly, withdrawing money via M-Pesa from Exness is simple and quick. You just need to select “M-Pesa” under the “Withdrawal” icon in your Exness account. The minimum deposit and withdrawal amount via M-Pesa is USD 1, and there are no processing fees.

Exness Pros

- $1 Low minimum deposit

- No deposit or withdrawal fees

- You can open KES-denominated accounts, avoiding conversion fees.

- Dedicated customer support team for Kenyan traders

- Dedicated customer support team for Kenyan traders

- Education resources

XM Cons

- Operates under a market maker license

- Higher spreads on beginner accounts

HFM

Editor Rating 4.8 ________ 4.8/5 HFM Kenya Review [table id=1 /]

Editor Rating 4.8 ________ 4.8/5 HFM Kenya Review [table id=1 /]

HFM checks all the right boxes for Kenyan traders seeking a forex broker that accepts Mpesa. HFM’s regulatory compliance, robust trading platform, competitive fees, Mpesa payments, and award-winning app make it a leading choice for Forex brokers with Mpesa in Kenya.

HFM Official Website Why Choose HFM?

Updated: HF Markets Kenya Review

Detailed HFM Review

HFM (formerly known as HotForex) has emerged as one of the top choices for Kenyan traders looking for a forex broker that accepts Mpesa. The minimum deposit and withdrawal via Mpesa is just 300 KES, making it very accessible. Withdrawals are processed within 24 hours.

Depositing and withdrawing funds with HFM using Mpesa is quick and convenient. There are no fees or charges applied by the broker for Mpesa transactions, and the minimum deposit is only $5, one of the lowest in the industry. With HFM, Mpesa deposits are credited instantly so you can start trading right away. Withdrawals via Mpesa are also processed rapidly within 24 hours.

Importantly for Kenyan traders, HFM is regulated locally by the Capital Markets Authority (CMA) of Kenya under license number 155. Local regulation provides oversight and security when dealing with a forex broker.

HFM offers a multi-asset trading platform, providing trading services to both retail and institutional clients. It offers a wide selection of over 1,000 CFDs and 47 forex pairs.

HFM also offers a proprietary copy trading platform, HFcopy, allowing you to follow and replicate the strategies of successful traders. This feature can be particularly useful if you’re new to Forex trading or if you’re looking to diversify your trading strategies.

HFM also has an education center with trading courses, video tutorials, e-books, and webinars for beginner to advanced traders. The also broker also provides daily market news and analysis from its team of experts.

HFM Pros

- Extensive Regulation and Security of Funds

- Tight spreads starting from 0 pips on its Zero account.

- No fees or charges applied for Mpesa transactions

- Ongoing Education and Market Analysis

- Dedicated customer support team for Kenyan traders

HFM Cons

- Limited tradable assets (~400)

HFM (formerly known as HotForex) has emerged as one of the top choices for Kenyan traders looking for a forex broker that accepts Mpesa. The minimum deposit and withdrawal via Mpesa is just 300 KES, making it very accessible. Withdrawals are processed within 24 hours.

Depositing and withdrawing funds with HFM using Mpesa is quick and convenient. There are no fees or charges applied by the broker for Mpesa transactions, and the minimum deposit is only $5, one of the lowest in the industry. With HFM, Mpesa deposits are credited instantly so you can start trading right away. Withdrawals via Mpesa are also processed rapidly within 24 hours.

Importantly for Kenyan traders, HFM is regulated locally by the Capital Markets Authority (CMA) of Kenya under license number 155. Local regulation provides oversight and security when dealing with a forex broker.

HFM offers a multi-asset trading platform, providing trading services to both retail and institutional clients. It offers a wide selection of over 1,000 CFDs and 47 forex pairs.

HFM also offers a proprietary copy trading platform, HFcopy, allowing you to follow and replicate the strategies of successful traders. This feature can be particularly useful if you’re new to Forex trading or if you’re looking to diversify your trading strategies.

HFM also has an education center with trading courses, video tutorials, e-books, and webinars for beginner to advanced traders. The also broker also provides daily market news and analysis from its team of experts.

HFM Pros

- Extensive Regulation and Security of Funds

- Tight spreads starting from 0 pips on its Zero account.

- No fees or charges applied for Mpesa transactions

- Ongoing Education and Market Analysis

- Dedicated customer support team for Kenyan traders

HFM Cons

- Limited tradable assets (~400)

AvaTrade

Editor Rating 4.8 ________ 4.8/5 AvaTrade Review [table id=1 /]

Editor Rating 4.8 ________ 4.8/5 AvaTrade Review [table id=1 /]

AvaTrade is a prestigious forex broker that accepts Mpesa payments in Kenya, making it one of the best choices for Kenyan traders. Established in 2006, AvaTrade is regulated by tier-1 and tier-2 financial authorities such as the FSCA and the FSA.

Although AvaTrade is not regulated by the Capital Markets Authority (CMA) in Kenya, it is still a trusted and highly recommended broker for Kenyan traders who want to participate in global financial markets.

AvaTrade Official Website Why Choose AvaTrade?#### Detailed AvaTrade Review

AvaTrade is one of the leading online forex and CFD brokers that provides trading services to clients globally.

Founded in 2006, AvaTrade has over 16 years of experience in the brokerage industry. The broker is regulated by top-tier financial authorities like the Central Bank of Ireland, ASIC in Australia, FSCA in South Africa, and FSA in Japan. This ensures client funds safety and proper regulation of trading activities.

AvaTrade accepts Mpesa payments in Kenya. Deposits and withdrawals via Mpesa are processed instantly by AvaTrade with no delays. This enables traders to quickly fund their accounts and withdraw profits. The quick processing eliminates the long wait times associated with bank transfers or card payments.

Additionally, AvaTrade does not charge any fees for Mpesa deposits or withdrawals. This helps you avoid the deposit and withdrawal fees common with other payment methods.

AvaTrade offers a wide range of trading instruments, including forex, stocks, commodities, cryptocurrencies, and indices. The broker provides various trading platforms such as MetaTrader 4, MetaTrader 5, Ava Social, and Ava Protect, catering to different trading needs.

AvaTrade Pros

- Regulated broker with strong trust credentials

- Accepts M-Pesa deposits from Kenya

- Wide selection of tradable assets

- Advanced trading platforms and tools

- Educational resources for beginner traders

AvaTrade Cons

- AvaTrade charges inactivity fees of $50 per quarter after 3 months of no trading

- They do not accept crypto deposits or withdrawals despite growing industry adoption

AvaTrade is one of the leading online forex and CFD brokers that provides trading services to clients globally.

Founded in 2006, AvaTrade has over 16 years of experience in the brokerage industry. The broker is regulated by top-tier financial authorities like the Central Bank of Ireland, ASIC in Australia, FSCA in South Africa, and FSA in Japan. This ensures client funds safety and proper regulation of trading activities.

AvaTrade accepts Mpesa payments in Kenya. Deposits and withdrawals via Mpesa are processed instantly by AvaTrade with no delays. This enables traders to quickly fund their accounts and withdraw profits. The quick processing eliminates the long wait times associated with bank transfers or card payments.

Additionally, AvaTrade does not charge any fees for Mpesa deposits or withdrawals. This helps you avoid the deposit and withdrawal fees common with other payment methods.

AvaTrade offers a wide range of trading instruments, including forex, stocks, commodities, cryptocurrencies, and indices. The broker provides various trading platforms such as MetaTrader 4, MetaTrader 5, Ava Social, and Ava Protect, catering to different trading needs.

AvaTrade Pros

- Regulated broker with strong trust credentials

- Accepts M-Pesa deposits from Kenya

- Wide selection of tradable assets

- Advanced trading platforms and tools

- Educational resources for beginner traders

AvaTrade Cons

- AvaTrade charges inactivity fees of $50 per quarter after 3 months of no trading

- They do not accept crypto deposits or withdrawals despite growing industry adoption

Pepperstone

Editor Rating 4.8 ________ 4.8/5 Pepperstone Kenya Review [table id=11 /]

Editor Rating 4.8 ________ 4.8/5 Pepperstone Kenya Review [table id=11 /]

Pepperstone allows Kenyan traders to easily fund their accounts using Mpesa. Deposits are instant with no fees or charges. Traders can start trading in a hassle-free manner with as little as $1. Withdrawals via Mpesa are also quick, with funds hitting your Mpesa wallet within 24 hours.

Pepperstone Official Website Why Choose Pepperstone?#### Detailed Pepperstone Review

Founded in 2010, Pepperstone has quickly grown to become one of the largest forex brokers in the world.

Apart from being a CMA-regulated forex broker, Pepperstone is also regulated by top-tier financial authorities like the UK’s Financial Conduct Authority (FCA), Australia’s Securities and Investments Commission (ASIC), and Germany’s Federal Financial Supervisory Authority (BaFin). This ensures that client funds are kept in segregated accounts and provides recourse in case of any disputes. Traders can feel confident their money is safe with Pepperstone.

Pepperstone accepts Mpesa for both deposits and withdrawals. This makes it convenient for Kenyan traders to fund and withdraw money from their trading accounts.

The broker provides the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. For advanced traders, Pepperstone also offers the institutional-grade cTrader platform with advanced charting, trading analytics, and algorithmic trading options.

With Pepperstone, you can trade over 700 instruments across a large range of asset classes, including FX, CFDs, and commodities. This provides you with more trading opportunities and the flexibility to diversify your trading portfolio.

Overall, Pepperstone is considered one of the top forex brokers globally and is a great option for Kenyan traders looking to use Mpesa. The company provides a well-regulated and secure trading environment, competitive spreads and fees, fast execution speeds, and good customer service.

However, Pepperstone also has some limitations around educational resources, risk management tools, withdrawal fees in some cases, and negative balance protection coverage.

Pepperstone Pros

- Competitive Spreads and Execution

- Multiple Trading Platforms

- Pepperstone allows fast, fee-free deposits and withdrawals via Mpesa in Kenya

- Top-notch 24/5 customer service

- Educational resources for beginner traders

Pepperstone Cons

- Limited educational resources compared to other brokers

- Withdrawal fees are high for bank wire transfers

Founded in 2010, Pepperstone has quickly grown to become one of the largest forex brokers in the world.

Apart from being a CMA-regulated forex broker, Pepperstone is also regulated by top-tier financial authorities like the UK’s Financial Conduct Authority (FCA), Australia’s Securities and Investments Commission (ASIC), and Germany’s Federal Financial Supervisory Authority (BaFin). This ensures that client funds are kept in segregated accounts and provides recourse in case of any disputes. Traders can feel confident their money is safe with Pepperstone.

Pepperstone accepts Mpesa for both deposits and withdrawals. This makes it convenient for Kenyan traders to fund and withdraw money from their trading accounts.

The broker provides the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. For advanced traders, Pepperstone also offers the institutional-grade cTrader platform with advanced charting, trading analytics, and algorithmic trading options.

With Pepperstone, you can trade over 700 instruments across a large range of asset classes, including FX, CFDs, and commodities. This provides you with more trading opportunities and the flexibility to diversify your trading portfolio.

Overall, Pepperstone is considered one of the top forex brokers globally and is a great option for Kenyan traders looking to use Mpesa. The company provides a well-regulated and secure trading environment, competitive spreads and fees, fast execution speeds, and good customer service.

However, Pepperstone also has some limitations around educational resources, risk management tools, withdrawal fees in some cases, and negative balance protection coverage.

Pepperstone Pros

- Competitive Spreads and Execution

- Multiple Trading Platforms

- Pepperstone allows fast, fee-free deposits and withdrawals via Mpesa in Kenya

- Top-notch 24/5 customer service

- Educational resources for beginner traders

Pepperstone Cons

- Limited educational resources compared to other brokers

- Withdrawal fees are high for bank wire transfers

FBS

Editor Rating 4.4 ________ 4.4/5 FBS Review [table id=16 /]

Editor Rating 4.4 ________ 4.4/5 FBS Review [table id=16 /]

FBS offers floating spreads as low as 0 pips on the EUR/USD for their Standard account. They also provide high leverage up to 1:3000, fast execution speeds, and fractional pip pricing.

FBS allows Kenyan traders to deposit and withdraw funds through Mpesa, which is the most popular mobile money transfer service in the country.

FBS Official Website Why Choose FBS?#### Detailed FBS Review

FBS is an international forex broker founded in 2009 and headquartered in Belize. It has regional offices in Cyprus, Malaysia, Indonesia and China. FBS is regulated by several top-tier financial regulators including the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC) and the Financial Sector Conduct Authority (FSCA) of South Africa.

With over 27 million registered traders across 150 countries, FBS is one of the largest retail forex brokers globally.

One of the biggest advantages of using FBS for Kenyans is the ability to deposit and withdraw funds using Mpesa. Depositing via Mpesa is instantaneous, allowing Kenyans to quickly fund their trading accounts. Withdrawals are also processed faster compared to traditional bank wire transfers.

In addition to Mpesa, FBS offers competitive trading conditions to attract Kenyan traders. The minimum deposit is only $5, one of the lowest in the industry. The maximum leverage of up to 1:3000 allows traders to enter larger positions for potentially higher returns.

For Kenyan traders still learning the ropes, FBS offers a treasure trove of educational resources. These resources provide valuable information to help you trade confidently.

FBS Pros

- Accepts M-Pesa for deposits and withdrawals

- Competitive spreads and commissions

- High leverage up to 1:3000

- FBS provides trading tutorials, daily analysis, webinars

FBS Cons

- FBS is not regulated by the CMA in Kenya

- Some traders report occasional requotes and slippage during volatile markets

FBS is an international forex broker founded in 2009 and headquartered in Belize. It has regional offices in Cyprus, Malaysia, Indonesia and China. FBS is regulated by several top-tier financial regulators including the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC) and the Financial Sector Conduct Authority (FSCA) of South Africa.

With over 27 million registered traders across 150 countries, FBS is one of the largest retail forex brokers globally.

One of the biggest advantages of using FBS for Kenyans is the ability to deposit and withdraw funds using Mpesa. Depositing via Mpesa is instantaneous, allowing Kenyans to quickly fund their trading accounts. Withdrawals are also processed faster compared to traditional bank wire transfers.

In addition to Mpesa, FBS offers competitive trading conditions to attract Kenyan traders. The minimum deposit is only $5, one of the lowest in the industry. The maximum leverage of up to 1:3000 allows traders to enter larger positions for potentially higher returns.

For Kenyan traders still learning the ropes, FBS offers a treasure trove of educational resources. These resources provide valuable information to help you trade confidently.

FBS Pros

- Accepts M-Pesa for deposits and withdrawals

- Competitive spreads and commissions

- High leverage up to 1:3000

- FBS provides trading tutorials, daily analysis, webinars

FBS Cons

- FBS is not regulated by the CMA in Kenya

- Some traders report occasional requotes and slippage during volatile markets

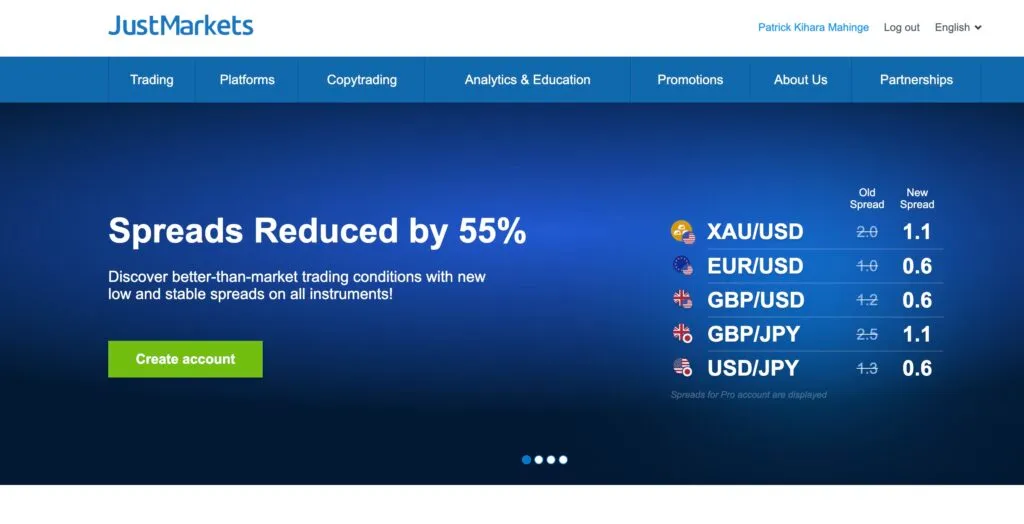

JustMarkets

Editor Rating 4.4 ________ 4.4/5 JustMarkets Review

Editor Rating 4.4 ________ 4.4/5 JustMarkets Review

JustMarkets offers a range of attractive features that make it a top choice for traders. They provide the lowest spreads, high leverage up to 1:3000, and more than 90 financial instruments.

This wide range of offerings allows traders to diversify their portfolios and find opportunities in various markets.

JustMarkets Official Website Why Choose JustMarkets?#### Detailed JustMarkets Review

There are several key reasons why JustMarkets stands out, but a major advantage is their acceptance of Mpesa for deposits and withdrawals.

This makes funding trading accounts incredibly convenient for Kenyans, as Mpesa is widely used across the country. JustMarkets offers flexible leverage up to 1:3000, tight spreads starting from 0 pips, and over 90 tradable assets including forex, metals, indices, energies, and cryptocurrencies.

Additionally, JustMarkets is regulated by tier-1 authorities like CySEC, FSC Mauritius, and FSCA South Africa, ensuring the safety of your funds.

JustMarkets’ acceptance of Mpesa reflects their dedication to meeting the unique needs of Kenyan traders. They have recognized that traditional payment methods may not always be the most practical or convenient for their local clientele.

They provide a choice between ECN and Standard accounts to suit different trading styles and offer swap-free Islamic accounts.

JustMarkets Pros

- JustMarkets allows for deposits and withdrawals via Mpesa

- Low Spreads and Fast Execution

- Wide Range of Trading Instruments

- JustMarkets offers a high maximum leverage ratio

JustMarkets Cons

- JustMarkets does not offer trading accounts denominated in Kenyan Shilling

- JustMarkets is not regulated by the Capital Markets Authority of Kenya

There are several key reasons why JustMarkets stands out, but a major advantage is their acceptance of Mpesa for deposits and withdrawals.

This makes funding trading accounts incredibly convenient for Kenyans, as Mpesa is widely used across the country. JustMarkets offers flexible leverage up to 1:3000, tight spreads starting from 0 pips, and over 90 tradable assets including forex, metals, indices, energies, and cryptocurrencies.

Additionally, JustMarkets is regulated by tier-1 authorities like CySEC, FSC Mauritius, and FSCA South Africa, ensuring the safety of your funds.

JustMarkets’ acceptance of Mpesa reflects their dedication to meeting the unique needs of Kenyan traders. They have recognized that traditional payment methods may not always be the most practical or convenient for their local clientele.

They provide a choice between ECN and Standard accounts to suit different trading styles and offer swap-free Islamic accounts.

JustMarkets Pros

- JustMarkets allows for deposits and withdrawals via Mpesa

- Low Spreads and Fast Execution

- Wide Range of Trading Instruments

- JustMarkets offers a high maximum leverage ratio

JustMarkets Cons

- JustMarkets does not offer trading accounts denominated in Kenyan Shilling

- JustMarkets is not regulated by the Capital Markets Authority of Kenya

Pros and Cons of Trading Forex Using M-Pesa

Using M-Pesa as a payment method on forex brokers in Kenya comes with several advantages and disadvantages:

-

Cost-Effective: M-Pesa provides a cost-effective payment solution for forex trading, as it offers lower costs compared to foreign payment options

-

Accessibility: M-Pesa is widely used in Kenya, making it highly accessible for traders, and it allows for quick and easy deposits, transactions, and withdrawals

-

Stability and Trust: M-Pesa’s stability and widespread usage in Kenya reinforce trust, which is crucial for handling large amounts of money in forex trading

-

Limited Broker Support: The number of forex brokers that accept M-Pesa is still relatively low, limiting the options available to traders

-

Initial Verification Process: The initial verification process for using M-Pesa can be strenuous and time-consuming

What to Consider When Choosing Forex Brokers That Accept M-Pesa in Kenya

Regulation and Licensing

Ensure the broker is regulated and licensed by the Capital Markets Authority (CMA) in Kenya. This ensures that the broker complies with rules and regulations, protecting your investments.

Trading Platforms and Tools

Choose a broker that offers user-friendly trading platforms, such as MetaTrader 4 or MetaTrader 5, and provides a range of trading tools to help you make informed decisions.

Education and Training Resources

Successful forex trading requires continuous learning. Many brokers offer educational resources, such as webinars and tutorials, to help traders improve their skills and knowledge.

Account Types and Fees

Brokers offer different account types with varying features. Look for accounts with low or no commissions, as these can significantly impact your profits.

Copy Trading Options

Forex copy trading offers high-risk investors the opportunity to invest in forex trading. This account is ideal for traders and high-risk investors alike. Some forex brokers offer copy trading options, which can be a bonus feature to consider.

Related Articles

Best Forex Brokers With Withdrawable No Deposit Bonus

JustMarkets Kenya Review

10 Legit Investment Platforms in Kenya

Patrick Mahinge

Forex Trading Coach

Patrick Mahinge is a seasoned forex trading coach based in Kenya with over a decade of experience in financial markets.

Stay Updated with Forex Insights

Subscribe to our newsletter for expert trading tips, market analysis, and exclusive updates.

No spam. Unsubscribe anytime.

Related Articles

Contents

Patrick Mahinge

Patrick Mahinge is a seasoned forex trading coach based in Kenya with over a decade of experience in financial markets.