Is FXPesa Legit In Kenya? Find Out in Our Detailed Review

Table Contents

Are you considering diving into the world of forex trading but feeling overwhelmed by the myriad of platforms available? Fear not! In this FxPesa review, we will provide you with all the essential information you need to make an informed decision, ensuring you choose the right forex trading platform to kickstart your trading journey.

When it comes to the world of forex trading, finding the right forex broker can make all the difference in your success. You need a broker that understands your needs, offers a user-friendly platform, and provides top-notch customer support.

That’s why I’ve taken it upon myself to give you an in-depth review of FXPesa, a forex broker that has caught the attention of many aspiring forex traders in Kenya.

What is FxPesa?

FxPesa is a forex trading platform that operates in Kenya. It is a subsidiary of EGM Securities, which is East Africa’s first regulated non-dealing online forex broker. FxPesa offers a range of services including forex trading, commodities trading, and indices trading. They provide a platform that is user-friendly, secure, and designed to help traders like you and me succeed in the forex market.

FXPesa has been gaining traction in recent years, but how does it measure up to other forex brokers? In this comprehensive FxPesa review, I will share my experiences and insights on FXPesa, highlighting its strengths and weaknesses.

FxPesa Review Overview

Knowing the history, regulatory status, and affiliations of a trading platform is crucial to your peace of mind and trading success. We will delve into these aspects, helping you determine if FxPesa is a trustworthy platform for your forex trading ventures.

FXPesa is a reputable forex and CFD broker based in Nairobi, Kenya. It was founded in 2019 and is part of the Equiti Global Group. FXPesa is regulated by the Capital Markets Authority (CMA) in Kenya.

Next, we will explore the trading platforms FxPesa offers, both web-based and mobile applications. We will highlight the user interface, charting tools, technical indicators, order types, and social trading capabilities that can help you navigate the forex market with confidence and ease.

Following that, we will explore the various tradable assets and markets FxPesa offers. Knowing the range of trading options at your disposal allows you to diversify your portfolio and expand your trading opportunities. We will examine forex, indices, commodities, cryptocurrencies, stocks, and ETFs to give you a comprehensive understanding of what FxPesa brings to the table.

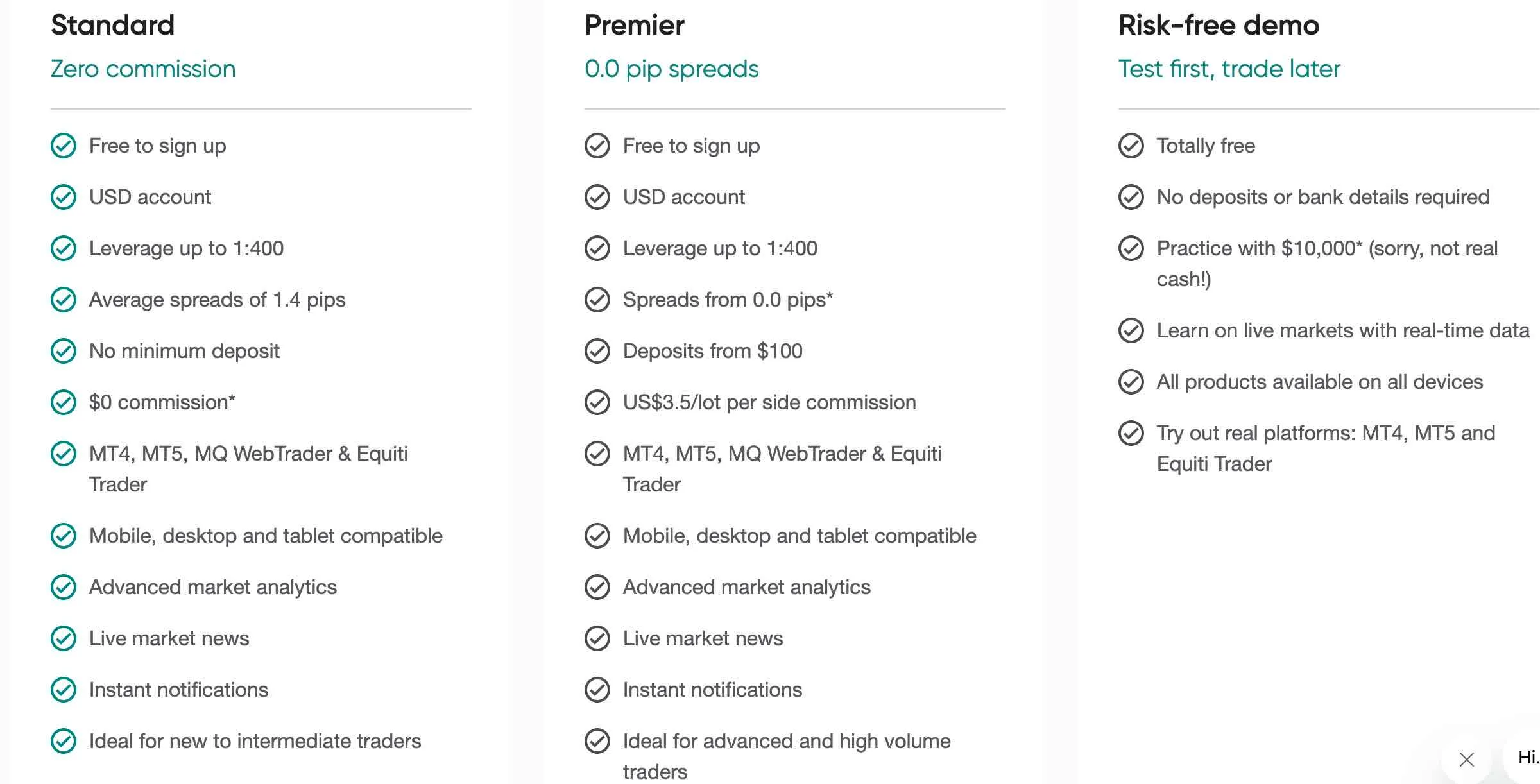

Account types play a significant role in your trading experience. To help you choose the account type that best suits your needs, we will outline the features and benefits of each account option, from the Standard and Premium to the VIP and Islamic accounts. Additionally, we will discuss the availability of a demo account, a valuable resource for you to practice your trading skills without risking your hard-earned money..

Understanding the costs associated with trading is vital, as it directly impacts your profit potential., and no trading platform is complete without a clear and transparent fee structure. We will examine the spreads, commissions, and fees associated with FxPesa, making sure you have all the necessary information to make an informed decision about your trading costs.

Understanding deposit and withdrawal options is crucial for any trader. We will discuss the available payment methods, processing times, and minimum deposit and withdrawal requirements, so you can efficiently manage your trading funds.

[table id=2 /]

Fxpesa Review - Is FxPesa Legit in Kenya?

FxPesa is a fully regulated non-dealing online foreign exchange broker. It’s licensed and regulated by Kenya’s Capital Markets Authority (CMA). This means that FxPesa operates under strict regulatory guidelines, ensuring a safe and secure trading environment for its clients.

Additionally, FxPesa is the trading name of EGM Securities, a premium online trading broker that is also regulated by the CMA. This double layer of regulation provides an extra level of security and trust for traders.

Factors That Prove FxPesa is Legit in Kenya

After taking FxPesa to the test for several months, I can confidenty confirm that it’s a legit forex and CFDs broker operating in Kenya and other parts of East Africa. Here are the key reasons that support FXPesa’s legitimacy:

-

Regulation: FXPesa is the trading name of EGM Securities Limited, which is licensed and regulated by the Capital Markets Authority (CMA) of Kenya under license number 107. The CMA is the regulatory body that oversees forex and CFD brokers in Kenya, providing oversight and protection for traders.

-

Reputation: FXPesa has been in operation since 2019 and has established a reputation as one of the best forex brokers in the East African region. They are a subsidiary of the Equiti Group, which holds licenses from multiple regulatory bodies, including the FCA, SCA, CySEC, and others.

-

Transparency: FXPesa provides detailed information about its operations, trading platforms, account types, and fees on its website. This level of transparency is a positive sign of a legit broker.

-

Trading Platforms: FXPesa offers popular trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary FXPesa Trader platform, which are widely used and trusted in the industry.

-

Security Measures: FXPesa claims to keep client funds in segregated accounts with top-tier banks, ensuring the protection of traders’ funds. Additionally, they implement measures like negative balance protection and an automated risk management system to protect traders from excessive losses.

-

Educational Resources: FXPesa provides educational resources, such as webinars, tutorials, and the FXPesa Academy, to help traders improve their skills and knowledge, which is a common practice among legitimate brokers.

-

Customer Support: FXPesa offers multiple channels for customer support, including live chat, email, and phone support, which is available 24/6.

Join FxPesa Today and Start Trading

Sign up now to get access to a wide range of trading instruments, competitive spreads, and exceptional customer support.

FxPesa is not only legit but also one of the best forex brokers in Kenya. Its strong regulation, advanced trading platforms, competitive spreads and fees, a wide range of trading instruments, easy deposits and withdrawals, and excellent customer support make it a top choice for Kenyan forex traders. So, if you’re looking to dive into the exciting world of forex trading, FxPesa could be the perfect broker for you.

FXPesa is a fully licensed and regulated forex broker in Kenya. In fact, the broker ranks #1 in our list of CMA licensed forex brokers, and for good reasons too, as this FxPesa review will show.

To start with, FXPesa is based on a very popular forex trading platform called MetaTrader 4 (MT4) that you can download on the broker’s website once you sign up for a live or demo account.

FXPesa provides beginners in forex trading a revolutionary trading technology. Most importantly you can start trading with just a minimum deposit $10, that is roughly 1,100/= in local currency. That is a great opportunity for forex newbies to experience real forex trading and practice their trading skills with minimal investment.

However, we do not recommend trading forex with such a low amount, and neither does Fxpesa. The low deposit amount is for traders who only want to test drive the trading platform without any serious trading going on,

If you want to get the best out of the markets, we recommend you start trading with a minimum deposit of $100 (11,000/=). With proper risk management and leverage, this amount can give you enough returns to cater for your day to day needs. Also, FxPesa gives new traders a welcome bonus of 30% for any deposit amount above $100.

FxPesa also offers competitive trading conditions for Forex professionals in Kenya, and provides a dedicated Forex trading server and experienced customer support as well as analysis of Forex market and a professional affiliate program.

Before opening a live FxPesa account you can practice your forex trading skills via the FxPesa demo account. It will help you test yourself in real forex environment, experience all the trading platform features and evaluate FxPesa without any financial risk.

The demo account doesn’t differ from a live account. A demo account does not differ from a live one except for the fact that you take no risks while trading, since you do not need a deposit on this account.

With FxPesa you get two choices of live trading accounts. the Executive Account and the Premier Account.

Is FxPesa regulated in Kenya?

Yes. Fx Pesa is fully licensed and regulated by the CMA. In fact, it was the first forex broker to get licensed by the CMA.

FxPesa Minimum Deposit

FxPesa offers two types of accounts: the Executive account and the Premiere account. The Executive account requires a minimum deposit of just $5 or its equivalent in Kenyan Shillings.

Now, you might be wondering, why FxPesa has such a low minimum deposit. It’s simple. FxPesa wants to make forex trading accessible to everyone, not just the high rollers. By setting a low minimum deposit, FxPesa is opening the doors of forex trading to ordinary Kenyans who might not have huge amounts of capital to invest.

However, while the minimum deposit in FxPesa is 5 USD only, it might be wise to start with a bit more if you can afford it. This is because having a larger initial deposit can give you more flexibility in your trading. It allows you to withstand potential losses and continue trading.

| Account Type | Minimum Deposit |

|---|---|

| Standard | $0 |

| Premium | $100 |

.fxpesa-table { width: 100%; border-collapse: collapse; margin: 0 auto; background-color: #fff; box-shadow: 0px 0px 10px rgba(0, 0, 0, 0.1); }

.fxpesa-table th { background-color: #009688; color: #fff; font-size: 18px; padding: 12px; text-align: left; border: none; }

.fxpesa-table td { font-size: 16px; padding: 12px; text-align: left; border: 1px solid #ddd; }

.fxpesa-table tr:nth-child(even) { background-color: #f2f2f2; }

.fxpesa-table tr:hover { background-color: #ddd; }

@media (max-width: 768px) { .fxpesa-table th, .fxpesa-table td { font-size: 14px; } }

But before you rush off to deposit money on FxPesa, here’s a word of advice. Forex trading is not a guaranteed way to make money. It’s risky, and you should only invest money that you can afford to lose.

Start small, learn the ropes, and don’t be tempted to invest more than you can afford to lose.

If you’re a beginner, it might be a good idea to start with a minimum deposit of KES 10,000. This will allow you to get a feel for the FxPesa trading platform and learn the ropes without risking a large sum of money. As you gain more experience and confidence, you can gradually increase your investment.

Also, remember that while FxPesa’s low minimum deposit is attractive, it’s not the only factor to consider when choosing a forex broker in Kenya. Look at the trading platform, customer service, and the range of available trading instruments. And most importantly, make sure the broker is regulated by a reputable authority.

FxPesa Minimum Withdrawal

FXPesa allows you to withdraw your funds at any time. However, the withdrawal process might take some time depending on the method you choose. For card withdrawals, it may take between 5 to 15 working days for the funds to be received by the client. If you’re using mobile money providers like M-Pesa, it may require up to 3 hours for the funds to be processed and received into your account.

The minimum amount you can withdraw from FxPesa using M-Pesa is 1 USD or its equivalent in Kenya shillings. As of the current exchange rate, 1 USD is approximately 157 Kenyan Shillings.

To withdraw your funds, you simply need to request a withdrawal through FXPesa’s client portal. The team processes requests daily, and if you submit your request before 15:00 EAT on a business day, it may be processed the same day.

Difference Between FxPesa Premier and Executive Account

The FxPesa Premier account is an ECN account. It has spreads as low as zero pips, and is best tailored for high volume and experienced traders. Instead of charging pips, the Premier Account charges a $7 commission per one lot round turn on forex pairs and precious metals and $10 CFDs.

It might sound as if $10 is a huge amount of money to pay for trading, but in real sense, you’re actually paying peanuts to get connected directly to liquidity providers.

.ugb-a24eb05 .ugb-notification__item{border-radius:0px !important;background-color:rgba(255,255,255,1) !important}.ugb-a24eb05 .ugb-notification__item:before{background-color:#ffffff !important}.ugb-a24eb05 .ugb-notification__icon svg:not(.ugb-custom-icon){color:#00d084 !important}.ugb-a24eb05 .ugb-notification__icon{margin-left:auto !important;margin-right:auto !important;height:50px !important;width:50px !important;opacity:1 !important}.ugb-a24eb05 .ugb-notification__icon .ugb-icon-inner-svg,.ugb-a24eb05 .ugb-notification__icon .ugb-icon-inner-svg svg{width:50px !important;height:50px !important}.ugb-a24eb05 .ugb-notification__icon .ugb-icon-inner-svg{color:#00d084 !important}.ugb-a24eb05 .ugb-notification__description{color:var(—stk-global-color-88711,#313131) !important}.ugb-a24eb05 .ugb-button .ugb-button—inner{font-family:“Lato”,Sans-serif !important}.ugb-a24eb05 .ugb-button{background-color:#00d084;border-radius:100px !important}.ugb-a24eb05 .ugb-button .ugb-button—inner,.ugb-a24eb05 .ugb-button svg:not(.ugb-custom-icon){color:#ffffff !important}.ugb-a24eb05 .ugb-button:before{border-radius:100px !important}.ugb-a24eb05 .ugb-inner-block{text-align:center}.ugb-a24eb05.ugb-notification > .ugb-inner-block{max-width:600px !important}.ugb-a24eb05 .ugb-notification__icon .ugb-icon-inner-svg,.ugb-a24eb05 .ugb-notification__icon .ugb-icon-inner-svg svg *{color:#00d084 !important;fill:#00d084 !important}

One standard lot in the forex industry is equal to approximately $100,000, if trading the US dollar as the base currency. So, in real sense, you’re actually only paying 10 dollars to control millions of shillings. And, these commission can be paid in fractions. So, if you’re trading in 0.01 lots, you only get to pay $0.001 for every position that you open!

FxPesa Minimum Deposit

The other main difference between the FXPesa Premier Account and the Executive Account has to do with the minimum deposit allowed for the account types.

A minimum deposit of $100 is required when opening the Premier account as opposed to the minimum deposit of $10 dollars required for the FxPesa Executive account.

However, the minimum deposit allowed by FxPesa, in all honesty, should not form your basis of why you choose one account over the other. It is highly recommended that you have an initial capital of $100 regardless of the account type you want to trade.

FxPesa Spreads

The other main difference between the FxPesa Premier and Executive Account has to do with spreads. FxPesa spreads on the Premier Account start at 0.4 pips while spreads on the Executive Account start at 1.5 spreads.

In order to keep the spread low, it is recommended that you trade at times of high market activity, and we have already covered the best time to trade forex in Kenya.

Pro Tip

While it is obvious FxPesa doesn’t have the lowest spreads in the industry (HotForex and XM Forex have lower spreads), many beginner forex traders find the spreads attractive enough because of the level of support offered by FxPesa. In particular, opening an account to start trading is a breeze compared to the other brokers.

Here are my findings.

[table id=2 /]

FxPesa Leverage

Leverage in forex trading is a powerful tool that allows you to control a large position with a relatively small amount of capital. It’s like a loan provided by the broker that lets you trade larger amounts than what you have in your account.

When you use leverage, you’re essentially borrowing money from your broker to increase your trading position beyond what would be possible with your own funds alone. For example, with a 100:1 leverage ratio, you can control a position of $100,000 with just $1,000 of your own capital.

In Kenya, the Capital Markets Authority (CMA) permits a maximum leverage of 1:400 for forex brokers. This means that with a small deposit, you can hold a much larger position in the market. However, this also means that the risks are equally magnified.

FxPesa, a broker regulated by the CMA and FCA, offers a maximum leverage ratio of 1:400. This is quite high compared to many other regions where leverage is more restricted. With FxPesa, you can start trading with a minimum deposit of as low as $5 or its equivalent in Kenyan Shillings.

Leverage in forex is a double-edged sword, and we always recommend you use it conservatively. The maximum offered by FxPesa is more than enough for most traders. While leverage can magnify profits, it can also amplify losses. A tiny movement of the market against you can lead to high losses and possibly wipe out your entire account.

If you require a leverage higher than 1:400, you might want to take a look at international forex brokers such as FBS or XM Forex.

FXPesa Review: Should You Trade Forex With FxPesa?

.ugb-248b4b1 .ugb-button{background-color:#00d084}.ugb-248b4b1 .ugb-button .ugb-button—inner,.ugb-248b4b1 .ugb-button svg:not(.ugb-custom-icon){color:#ffffff !important}@media screen and (min-width:768px){.ugb-248b4b1 .ugb-feature__item{grid-template-columns:1.00fr 1.00fr !important}.ugb-248b4b1 .ugb-img{width:713px;height:auto !important}}

At Kenya Forex Firm, we love FxPesa and the pace it has set for other forex brokers to get regulated in the country. Having a broker who is locally regulated means that any trading disputes will be easier to resolve.

In addition to this, FxPesa is one of the brokers that takes time and effort to educate beginner forex brokers on the intricacies of online forex trading. The broker has a free online course available once you register on their website.

At Kenya Forex Firm, we love FxPesa and the pace it has set for other forex brokers to get regulated in the country. Having a broker who is locally regulated means that any trading disputes will be easier to resolve.

In addition to this, FxPesa is one of the brokers that takes time and effort to educate beginner forex brokers on the intricacies of online forex trading. The broker has a free online course for

Trading with a local broker is definitely attractive. It almost feels like the service is personalized to you. I can see why any number of you might prefer to trade with FXPesa:

-

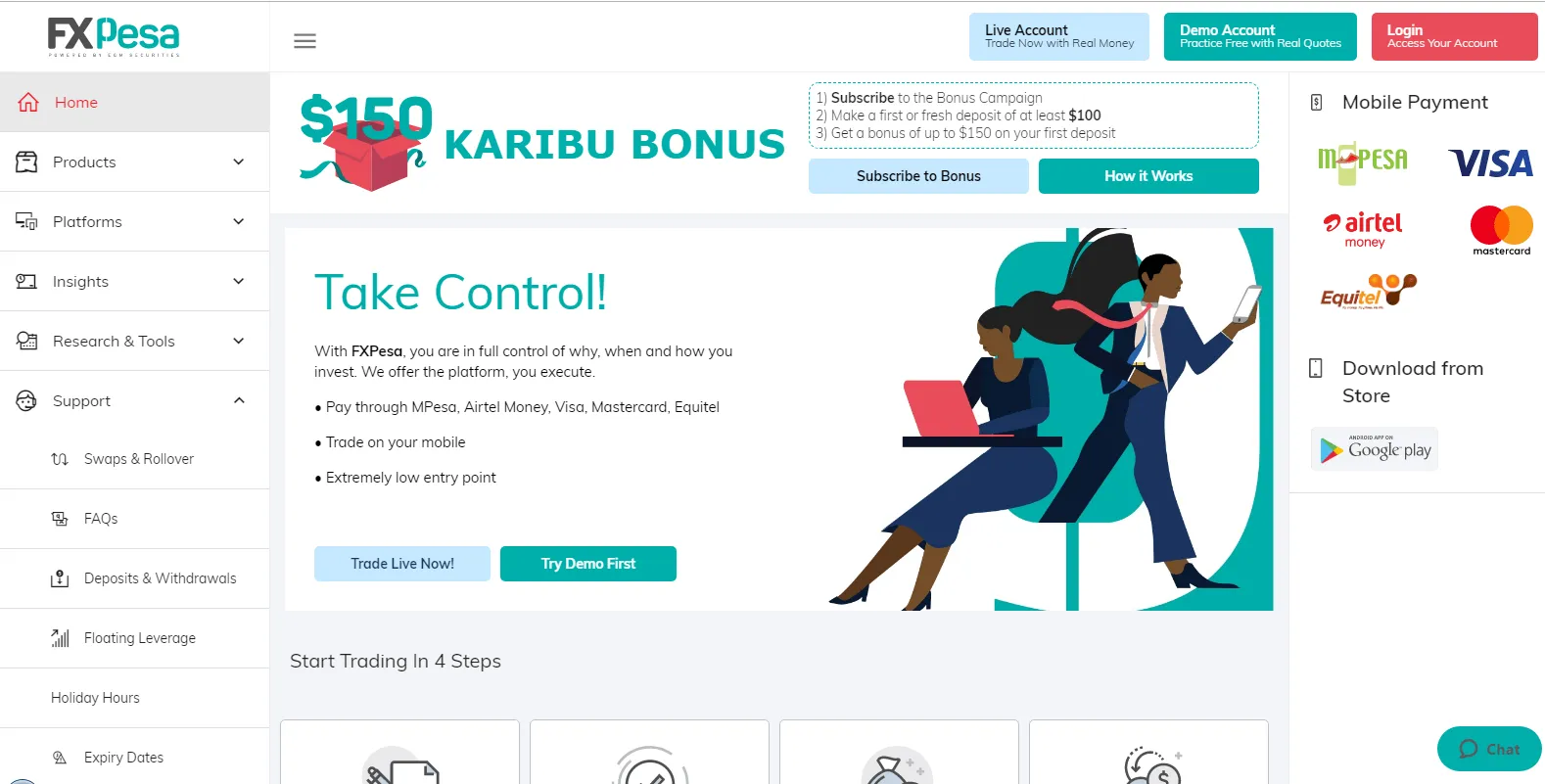

They accept local payment methods including Mpesa, Airtel Money, and Equitel (Best Forex Brokers That Accept Mpesa)

-

Account opening and verification is easier than with most international forex brokers.

-

FxPesa offers free forex trading education to traders in Kenya. Open a live trading account to benefit from this offer.

-

The 30% Fxpesa Karibu Bonus is a great incentive for traders who might not have sufficient capital to start trading

-

FxPesa is fully licensed and regulated by the Capital Markets Authority of Kenya (CMA)

FxPesa vs Scope Markets

Fxpesa vs ScopeMarkets Trading Fees & Spreads

FxPesa provides commission-free trading, depending on the account type you select. For instance, their Premiere accounts, which require a minimum deposit of $100, offer super-tight spreads from 0.0 pips. However, it’s important to note that FxPesa charges an inactivity fee when a live trading account goes dormant after 180 consecutive days.

On the other hand, Scope Market’s Silver account offers a spread of 1.1 pips for EURUSD and no commissions, while the Gold account offers a spread of 0.2 pips for EURUSD and a commission of $3.5 per side.

When comparing the two, FxPesa seems to offer lower spreads, starting from 0.0 pips, compared to ScopeMarkets, which offers spreads from 0.2 pips for its Gold account and 1.1 pips for its Silver account.

FxPesa vs Scope Markets Account Types

FXPesa offers a lower minimum deposit for its Executive Account compared to Scope Markets’ accounts. However, Scope Markets offers a tighter spread on its Gold Account compared to FXPesa’s accounts.

Both brokers offer a demo account and an Islamic account option. However, FXPesa offers managed accounts, while Scope Markets does not mention this feature.

Both FXPesa and Scope Markets offer competitive account types for forex traders in Kenya. Your choice between the two will depend on your trading style, risk tolerance, and preference for certain features such as spreads, commissions, and leverage.

Both FXPesa and Scope Markets have their strengths and weaknesses. FXPesa, with its user-friendly platform and low minimum deposit, is a great choice for beginners. However, its higher spreads might be a turn-off for more experienced traders.

Scope Markets, with its higher leverage and larger deposit bonus, might appeal to more seasoned traders. However, its higher minimum deposit and mixed reviews regarding platform stability could be a concern.

In the end, the choice between FXPesa and Scope Markets will depend on your individual trading needs and preferences. Always remember to do your own research and consider all factors before choosing a forex broker. Happy trading!

FXPesa Review: Is FxPesa Legit?

From the face of it, FXpesa is a legit forex broker that is owned by EGM Securities, a company that is registered and regulated by the Capital Markets Authority here in Kenya. Click here to register and start trading forex with FxPesa.

But there’s a more to the legitimacy of a broker more than just being registered and regulated.

Some regulatory authority carry more weight than others. You for instance can’t compare a broker that is regulated by the FCA with one that is regulated by CMA, as is the case with FX Pesa.

Both FXPesa and CMA are new to the world of online forex trading. CMA therefore lacks precedent on matters pertaining online forex trading.

While the steps that CMA has taken to regulate local forex brokers is commendable, I feel that there is still much work to be done.

With Forex trading becoming more and more popular in Kenya, brokers are having a field day setting up office in the country. One such broker is FXPesa. And like I always do with my forex broker reviews category on this website, I set out to find out whether FX Pesa is legit and how well it can serve you as a retail trader.

Patrick Mahinge

Forex Trading Coach

Patrick Mahinge is a seasoned forex trading coach based in Kenya with over a decade of experience in financial markets.

Stay Updated with Forex Insights

Subscribe to our newsletter for expert trading tips, market analysis, and exclusive updates.

No spam. Unsubscribe anytime.

Related Articles

Contents

Patrick Mahinge

Patrick Mahinge is a seasoned forex trading coach based in Kenya with over a decade of experience in financial markets.