IC Markets Kenya Review

Table Contents

Are you tired of dealing with unreliable Forex brokers in Kenya? Are you looking for a forex broker that can truly support your trading needs in Kenya? Look no further, because in this unbiased IC Markets review, we’ll cover everything from the trading platforms and fees to the customer service and more.

We’ve also included real-life examples from successful forex traders in Kenya who have used IC Markets, giving you a firsthand perspective of what it’s like to work with this particular forex broker. By the end of this review, you’ll have all the information you need to make an informed decision on whether IC Markets is the best Forex broker for you and whether it’s worth your investment.

IC Markets Kenya Review: Overview

IC Markets is one of the most reputable and well-established forex brokers in the industry today. Founded in 2007, the company has built a solid reputation for providing traders with high-quality trading platforms, competitive trading conditions, and excellent customer support.

In this IC Markets review, we’ll take an in-depth look at the key features and services offered by the broker, to help you decide if it’s the right choice for you.

Let’s start with an overview of what IC Markets has to offer:

[table id=30 /]

IC Markets was established in 2007 by a group of professionals with a wealth of experience in the financial industry. They saw a need for a Forex broker that could provide traders with access to tight spreads, fast execution, and a wide range of trading instruments. They believed that by focusing on these key areas, they could offer traders a superior experience compared to other brokers in the market.

IC Markets Review Key Takeaways

IC Markets is a regulated forex broker. They are regulated in 3 top-tier jurisdictions

The broker was founded in 2007

The minimum deposit on IC Markets is $200

IC Markets accepts PayPal, Neteller, Skrill and Wire Transfer payment methods. IC Markets does not accept Mpesa.

IC Markets is one of the few forex brokers that offer the cTrader trading platform in addition to MT4 and MT5

Read: Best Forex Brokers in Kenya With Mpesa

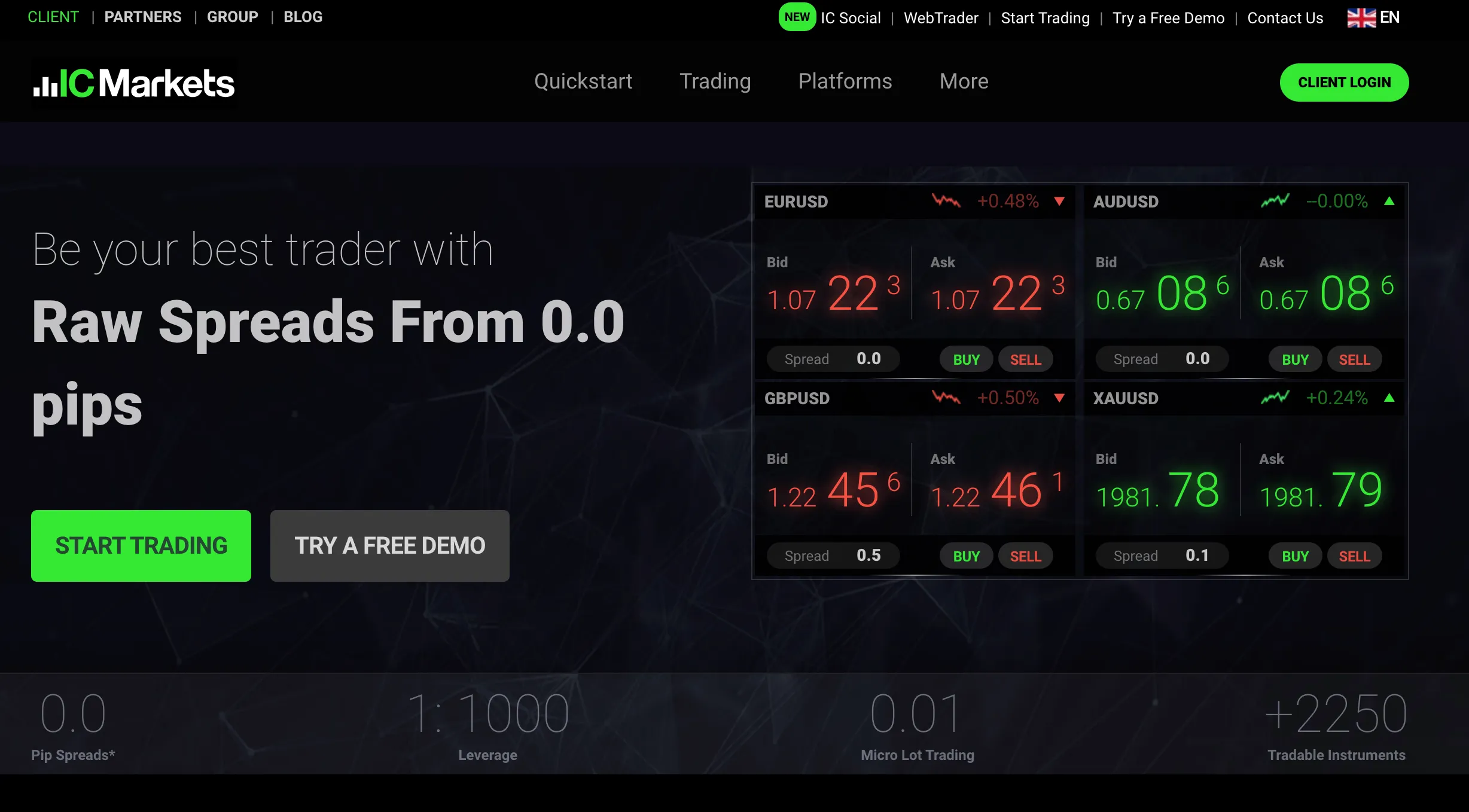

As you’ll find out later in this review, one of the key distinctions between IC Markets and other forex brokers in Kenya is their focus on providing low spreads. Of all the forex brokers we’ve reviewed, IC Markets has the lowest spreads on the standard accounts.

IC Markets also offers raw spread/ECN accounts which provide some of the tightest spreads in the industry, as low as 0.0 pips on major forex pairs such as EUR/USD. This makes IC Markets a great option for scalpers and high-frequency traders who rely on small price movements to make a profit.

IC Markets Account Types Review

When it comes to online forex trading in Kenya, the account type you choose can have a significant impact on your overall trading experience.

That’s why we take the time to thoroughly scrutinize each broker’s account types to ensure that our readers have access to accurate and reliable information.

Different account types come with different features and requirements, such as minimum deposit amounts and spreads, which can affect your profits and overall trading strategy.

When reviewing the best forex brokers in Kenya, we also take into account any special features that the account type may offer, such as access to institutional liquidity or compliance with Sharia law.

But our examination doesn’t stop there. At Kenya Forex Firm, we also test the account types by opening a live account and evaluating the trading conditions, such as execution speed, slippage and the overall trading experience.

By providing you with this information, we aim to empower you to make informed decisions about which forex broker and account type is right for you. We understand that every trader has unique needs and preferences, and our goal is to help you find a forex broker that fits those needs.

IC Markets Account Types

IC Markets offers 4 different account types to suit the needs of various forex traders in Kenya. These include:

-

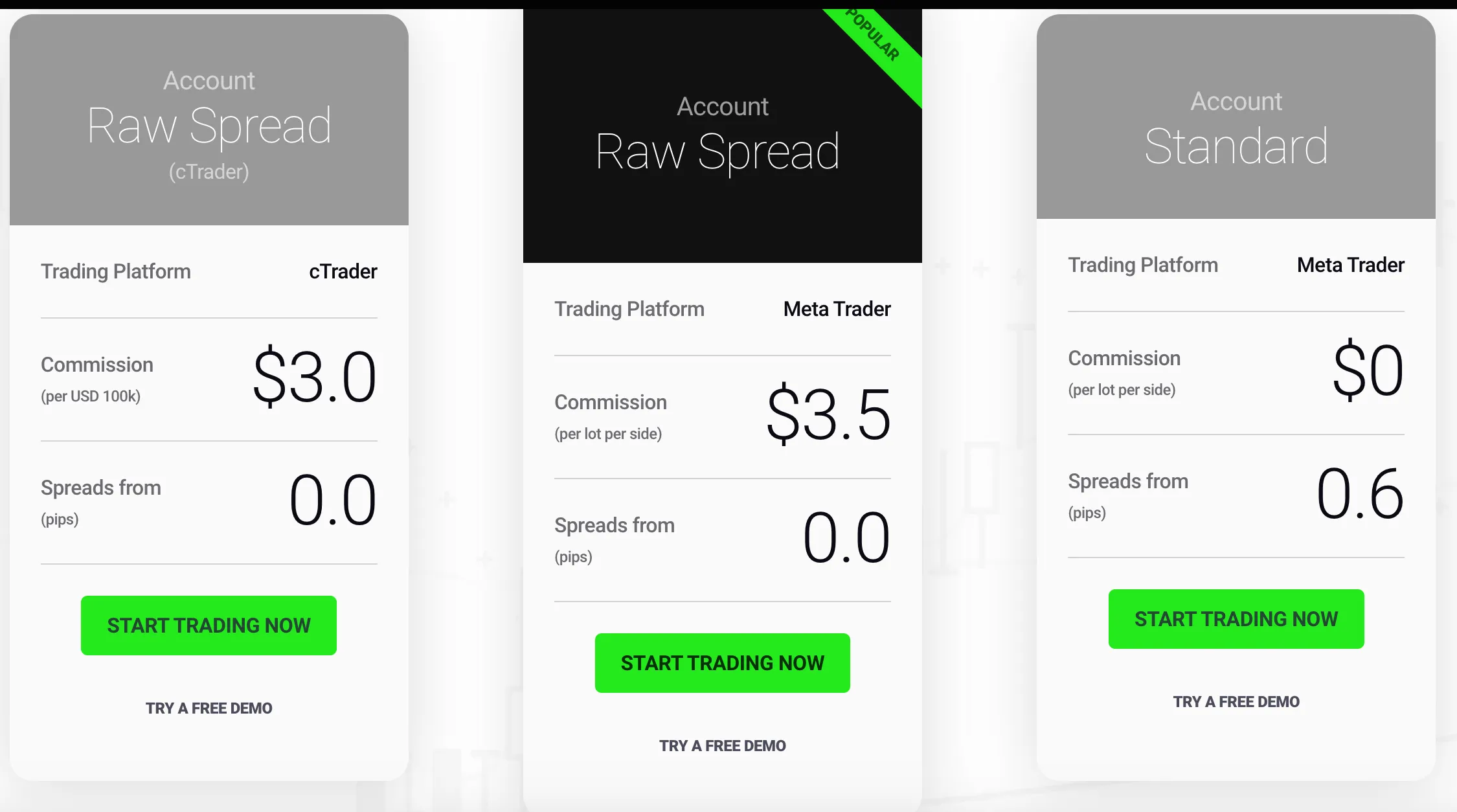

IC Markets Standard Account: This is the most basic account type offered by IC Markets. It requires a minimum deposit of $200 and allows for flexible trading with low spreads (0.6 pips on EUR/USD) and no commission. It is suitable for traders who want to trade with low capital and experience the market with a small investment.

-

Raw Spread Account: This account type is designed for experienced traders who want to trade with tight spreads and no markups. It requires a minimum deposit of $200 and offers raw spreads from 0.0 pips, with a commission of $3.00 per lot. It allows traders to access the interbank market and trade with institutional liquidity.

-

IC Markets cTrader Raw Spread Account: This account type is designed for traders who want to trade using the cTrader platform. It requires a minimum deposit of $200 and offers raw spreads from 0.0 pips, with a commission of $3.00 per lot. It allows traders to access the interbank market and trade with institutional liquidity.

-

IC Markets Islamic Account: This account type is designed for traders who follow the Islamic faith and want to trade with an account that is compliant with Sharia law. It requires a minimum deposit of $200 and offers low spreads and no commission.

IC Markets Account Funding and Withdrawal Review

The payment methods offered by a broker can have a big impact on your trading experience.

For one, you want to make sure that the payment methods offered by the broker are convenient for you. If you prefer to use a credit card, for example, you’ll want to make sure that the broker accepts that type of payment.

Additionally, if you’re trading large sums of money, you’ll want to be aware of any fees that may be associated with different payment methods.

Lastly, knowing the processing times for each payment method can also be crucial. If you need to move money quickly, you’ll want to make sure that the broker offers a payment method with fast processing times.

With that in mind, let’s take a look at the payment methods offered by IC Markets. We ranked them according to how convenient they are for Kenyan traders:

-

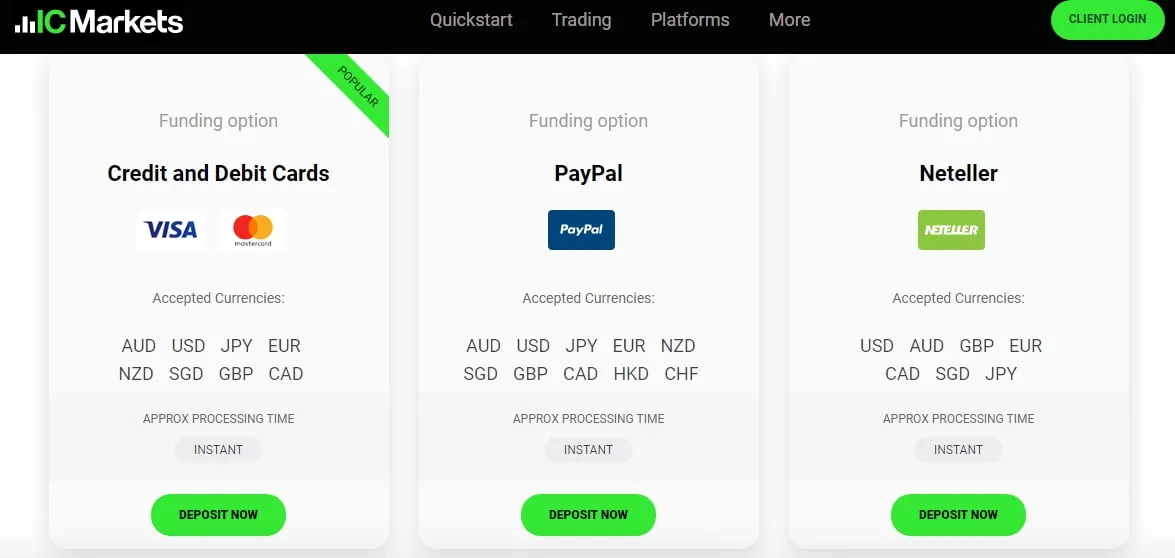

Credit/debit cards: IC Markets accepts a variety of credit and debit cards, including Visa and Mastercard. According to our review, this is the most fast and convenient way for Kenyan traders to fund their accounts. You can use any bank card to fund your account. Most traders we’ve talked to prefer to use the NCBA bank Loop card.

-

PayPal: PayPal payments have been made easier in Kenya thanks to Mpesa’s official integration with PayPal. This means that you can easily fund your PayPal account using Mpesa and also withdraw funds from your PayPal account to Mpesa. By accepting PayPal, IC Markets gives its clients another convenient and popular option for funding their accounts.

-

E-wallets: IC Markets supports a 2 popular e-wallets, namely Skrill and Neteller. This is a safe and secure way to fund your account, and transactions are typically processed in real-time. If you can’t use cards or PayPal to fund your account, these two e-wallets are what we’d recommend with a bias for Neteller as you can withdraw money from Neteller to Mpesa.

-

Bank wire transfer: If none of the above funding methods work for you, your last option will be bank wire transfer. This is a traditional method of transferring money between bank accounts which takes about 2-5 days to process. IC Markets accepts wire transfers in a variety of currencies, including USD, EUR, and GBP.

As for withdrawals, it is important to note that different withdrawal methods may have different processing times. Also, IC Markets may require additional information or documentation to verify your identity before processing your withdrawal request.

IC Markets does not charge any fee for deposits/withdrawals. This is a big plus as other forex brokers in Kenya usually charge a commission for withdrawals.

Withdrawal requests cut off time at IC Markets is is 12:00 AEST/AEDT. This translates to 4:00 AM Kenyan time. If you want IC Markets to process your withdrawals on the same day, you’ll have to make a request before this time.

IC Markets Minimum Deposit

IC Markets requires a minimum deposit of $200 (23,974 KES) to register a live trading account.

IC Markets Trading Platforms & Tools Review

IC Markets is one of the few forex brokers that gives traders a plethora of tools and trading platforms to make their trading as seamless as possible. The only other forex broker that comes anywhere near the offerings of IC Markets is Pepperstone Markets. But since this review is about IC Markets, we’ll limit ourselves to discussing the standout features that this broker offers.

To start with, it’s standard that any forex broker worth their name offers you the MetaTrader 4 or MetaTrader 5 trading platforms. IC Markets however goes a notch higher and includes the advanced cTrader platform among their trading platforms.

Let’s take a moment to look at each one of these IC Markets trading platforms for traders who might not be familiar with them:

-

The IC Markets MetaTrader 4 platform (MT4) is known for its user-friendly interface and advanced charting capabilities. It also offers a wide range of technical indicators and automated trading options. Additionally, the MT4 platform is available for both desktop and mobile devices, allowing you to access your account and trade on-the-go. IC Markets goes way and beyond and offers 20 more tools with their MT4 platform. These 20 tools are exclusive to IC Markets. You won’t find them with any other forex broker in Kenya.

-

The IC Markets MetaTrader 5 (MT5) platform is another option that you might wish to consider, especially if you wish to trade stocks, cryptocurrencies, indices and bonds. This platform is the successor of MT4 and offers a similar interface and features, but with some additional capabilities. Traders who are already familiar with the MT4 platform will find the transition to MT5 easy as it has similar features.

-

The IC Markets cTrader platform is designed for advanced traders and offers advanced charting, order management, and custom indicators. It also supports algorithmic trading and offers a wide range of APIs for custom integration. Like MT4, cTrader is also available for both desktop and mobile devices. Additionally, cTrader supports copy trading at IC Markets.

-

The IC Markets WebTrader is a web-based trading platform that allows you to access your account and trade directly from your web browser. This platform is ideal for traders who prefer not to download any software and want to trade from any device with an internet connection.

Availability of trading platforms and tools is one of the key factors that we use when reviewing forex brokers in Kenya, and in this regard, IC Markets scores impressively. It’s the one forex broker that goes way and beyond to offer custom trading tools on their trading platforms.

IC Markets also has a mobile trading app that will easily allow you to open an account, upload your verification documents and fund your account. The trading app is a godsent for traders who need to keep tabs on their trading accounts while they are on the go.

IC Markets Customer Support Review

One of the things that we scrutinize thoroughly when reviewing forex brokers in Kenya is the level and quality of customer support that they offer. Amazingly, it never ceases to surprise us about how many traders completely ignore customer support when choosing a forex broker to invest with.

A good customer support team will be able to assist you quickly and effectively, which can help you to make informed trading decisions. Additionally, a broker with good customer support can help you to navigate any challenges that may arise during the trading process, such as technical issues or account-related concerns. This is something that we never take lightly when reviewing and recommending the best forex brokers in Kenya.

When reviewing a forex broker’s customer support, we usually check the following things:

-

Communication channels offered by the broker

-

Availability and Responsiveness: The forex market is open 24 hours for 5 days of the week. Customer support should be available during all this time. The customer support should also be easily reachable via the communication channels that they offer.

-

Knowledge exhibited by the customer support agents: A broker’s support agents should be well-versed in the products and services offered by the broker. They should be able to provide you with accurate and helpful information.

Customer support is a critical aspect of any business, particularly in the financial industry. It is important for a forex broker to have a dedicated team of knowledgeable and responsive customer support representatives who can assist clients with any questions or issues they may have.

IC Markets offers excellent customer support for forex traders. The support team is available 24/7 through live chat, toll free phone calls, and email.

We found the support team quite knowledgeable and quick to respond to our questions and concerns. They were able to quickly solve most of the issues we had with our account and provided helpful guidance about using their trading platform.

One of the things we appreciated the most about IC Market’s customer support was their willingness to go the extra mile for us. For instance, on one occasion, we had an issue with our cTrader platform and the support team not only helped us to solve the issue but also stayed on the line until they were certain that everything was working properly.

Overall, we were very satisficed with the level of customer support offered by IC Markets. We give them a solid 4.5 out of 5 points for their exemplary customer support.

Frequently Asked Questions About IC Markets Kenya

Can IC Markets be Trusted?

Yes. IC Markets is a reputable and regulated online broker that offers trading in a wide range of financial instruments, including forex, commodities, indices, and cryptocurrencies. They have been in business since 2007 and are regulated by the Australian Securities and Investments Commission (ASIC), which is considered to be a reputable regulatory agency.

Can I use IC Markets in Kenya?

Yes. IC Markets can be used by traders based in Kenya. With its strong reputation in the industry, forex traders in Kenya can trust that their investments are in safe hands with IC Markets. The broker is regulated by several reputable financial authorities, including ASIC in Australia, CySEC in Cyprus, and the FCA in the UK. Although IC Markets does not hold a license from the local financial regulator in Kenya, its multiple regulations from reputable international authorities make it a safe choice for Kenyan traders.

In addition to its regulatory status, IC Markets is also known for its tight spreads and fast trade executions, making it an attractive choice for day traders. The low spreads allow traders to enter and exit trades quickly and efficiently, while fast trade executions ensure that trades are executed at the desired price.

Patrick Mahinge

Forex Trading Coach

Patrick Mahinge is a seasoned forex trading coach based in Kenya with over a decade of experience in financial markets.

Stay Updated with Forex Insights

Subscribe to our newsletter for expert trading tips, market analysis, and exclusive updates.

No spam. Unsubscribe anytime.

Related Articles

Contents

Patrick Mahinge

Patrick Mahinge is a seasoned forex trading coach based in Kenya with over a decade of experience in financial markets.