How To Master Forex Price Action Patterns

Table Contents

To be a successful trader it is important to master a price action strategy. It always surprises me that although price action is the most up to date information on any chart, so many amateur traders choose to focus instead on indicators.

What is Price Action Patterns?

We all hear that price action is the most important part of trading. The Holy Grail. But what is price action trading? Which price action trading strategies are the most important? Which ones help with entries? Which ones help with exits? Why is price action trading so important? Read on to find out which price action patterns can lead to profits in the Forex marketplace.

[su_note]Price action is the movement of price over a specific measure of time. By analyzing price action, a trader can identify specific, recurring price patterns and “predict” where price is most likely to go.

A price action Forex trading system uses these patterns and predictions to create rule-based trading systems that can be highly accurate!

Price action on your chart is a visual representation of the “state-of-mind” of the big market players moving the currencies. (The Forex market is made up of the people trading it, and the markets move primarily from the participation of the big players).

Therefore, by analyzing the behavior of price one can make an informed interpretation of what the “market makers” are doing at any given time.

As forex traders in Kenya, we can use this information to make high probability trading decisions. While we cannot move the markets ourselves, we can use our price action trading system to jump on-board the profitable market moves created by the big traders. And since these price action patterns happen over and over again, we can enjoy consistency in our trading… which is the key to long term success![/su_note]

Let me rephrase that…

Price Action is the visual representation of the price of a specific market, normally over a specified period of time. It is the most important part of any chart, as it is contains the most recent and relevant price data.

Most, if not all indicators lag behind the current price. Sometimes they will give you the top or the bottom of that particular trading phase.

We typically view price as either ‘bars’ or ‘candles’. They tell us exactly the same information, yet they are displayed in slightly different ways.

There are lots of different price action strategies that you can learn in our Learn Forex and Pro Forex training courses. Each one of them is capable of being used effectively to generate profits from the Forex marketplace. The the one which we will focus on today is the Pin Bar price action trading strategy.

The Pin Bar is one of the strongest price action strategy that can be used to generate consistent profits from the marketplace. When you understand how to trade the Pin Bar Trading Strategy, it can lead to very high reward:risk setups that can very easily get into 3:1 and 4:1 reward:risk ratios.

Pin Bar Setup

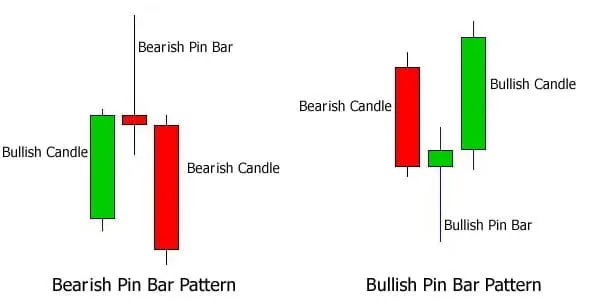

Pin Bar Price Action Trading Setup.

The Pin Bar pattern is a 1 bar pattern that commonly leads to strong price movements. It is perhaps one of the most popular price action trading strategy in the Forex marketplace. The Pin Bar itself cannot be used as a standalone technique. You need to add in support and resistance, moving averages and other context before you can trade the price action signal.

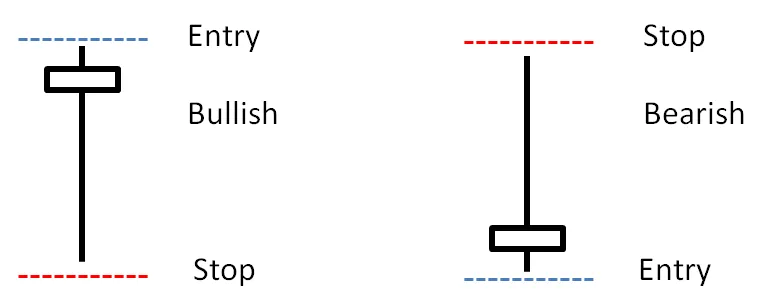

Take a look at the image below for the entry and stop loss placements for Pin Bars.

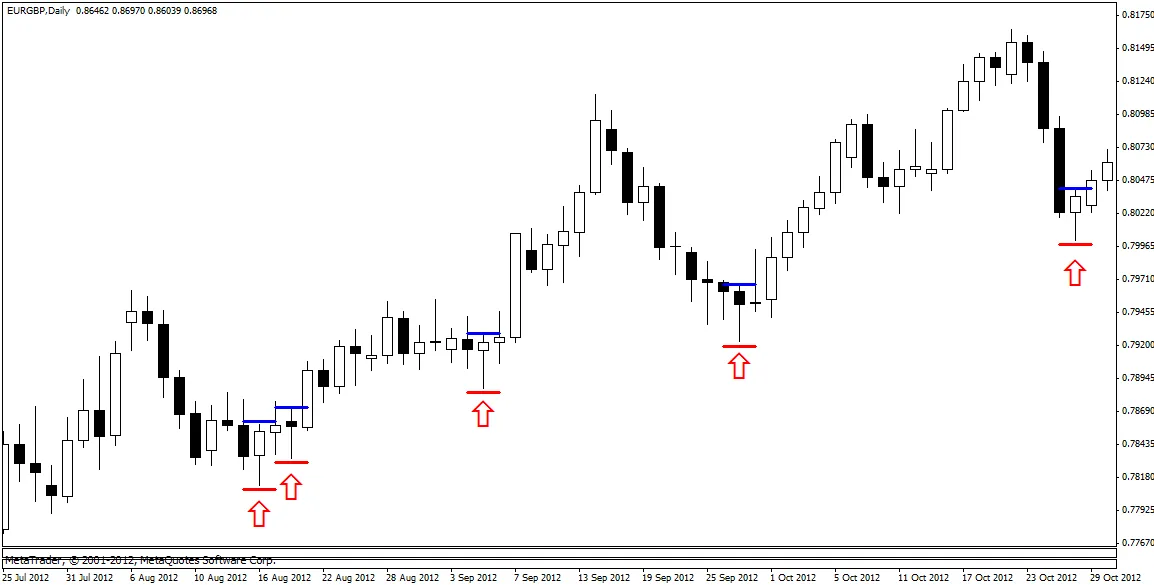

Below is the EURGBP Daily chart with the bullish Pin Bars highlighted. These bullish Pin Bars made excellent entry signals into the upward trend. Using the entry and stop loss method from above, you would have been able to profit from all of the strong moves in the direction of the overall trend.

Some of these trades would have been 1:1, some 2:1 and some 3:1 Reward:Risk ratios. The important part is that the Pin Bar setups lead to multiple high quality trade entries that resulted in good profits over this sample of trades.

Remember the pin bar setup cannot be traded without taking into account context of where the price action occurs. We look at how to trade the Pin Bar setup and more in our Learn Forex Program.

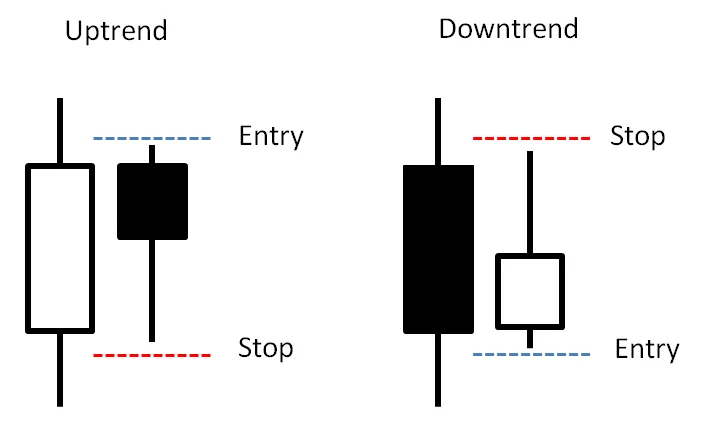

Inside Bar Price Action Setup.

Another great price action trading strategy is the Inside Bar price action pattern. It occurs fairly frequently on all timeframes, and provides an excellent entry with a tight stop loss, maximizing Reward:Risk ratio.

The ticks indicate likely winning trades in the direction of the trend. The crosses show the trades that were likely losing trades. Out of the 8 trades in this AUDNZD Daily chart downtrend, 6 were winning trades, while 2 were losing trades. The benefit of inside bars is the small risk on the trade. This means that the Reward:Risk ratio is improved. Some of the above trades reached up to 5:1 Reward:Risk, with the average being around 2:1 Reward:Risk.

The Pin Bar price action strategy that we will cover in this featured Forex lesson is a trend based trading strategy designed for the higher timeframes. The most suitable timeframes are the 1 hour, 4 hour and Daily charts.

If the open and close of the bar are in the upper 50%, then you have a Bullish Pin Bar.

If the open and close of the bar are in the lower 50%, you have a Bearish Pin Bar.

We look to trade Bullish Pin Bars in uptrend. We trade Bearish Pin Bars in downtrend. The chart below of USD/JPY on the daily timeframe highlights the Bullish Pin Bars in the uptrend. We can see how often this price action setup occurs. You would have made over 10% growth on your account on this 1 currency pair taking these setups.

Why trade with the trend?

Pin Bars are traded with the dominant trend, as this increases their success rate and their reward:risk ratio. Remember, with trading – less is more. We want to focus on the high probability opportunities, not every single opportunity.

Engulfing Bar Price Action Setup.

These ‘Engulfing Bars’ appear less frequently than other price action patterns. However that does not make them any less effective. They tend to be very strong price action signals that lead to strong price reversals. An Engulfing bar or Engulfing candle is as good an entry as either of last week’s price action setups. The difference with Engulfing bars are that they are as good a signal with the trend as against it.

Looking at the 4 trades in the above chart. 3 winners. 1 losing trade. We have 2 big winning trades and 1 small winning trade, making the Reward:Risk positive and weighted in our favor. The only downside to Engulfing Bars are the increased risk in pips on the trade. This means price needs to move further in our favor to achieve higher Reward:Risk ratios.

Above you can see the method for entering an Engulfing Bar trade. Remember you can’t just trade the Engulfing Bars on their own, you need to understand the context of price action trading which is taught in detail on our Learn Forex and Pro Forex courses.

Inside Bar Fakey Price Action Setup.

The Inside Bar Fakey Setup is a trend based price action trading strategy. It’s a 3 bar formation that can lead to great moves in the direction of the trend. We need to see an inside bar formation that leads to a false breakout. It’s the nature of the false breakout that leads to strong moves with the trend.

Every single one of the Inside Bar Fakey setups that triggered on the gold daily chart below lead to a winning trade. The hard part was having the discipline to only take the setups in the direction of the trend.

As you start to look at price action patterns in more detail you see how every single bar/candle has a story to tell. Some are more important than others, and it is not always the case that each price action setup is only 1 bar. Sometimes the setup can form over several bars (Inside Bar Fakey), or be multiple setups in 1 bar (Inside Pin Bar). The important part is to have context with your price action trades. Then execute your trades in the direction of the prevailing trend. This will likely lead to higher probability trades and a higher Reward:Risk.

Price Action Strategy

We have only looked at the Pin Bar price action strategy which should form part of your Forex trading plan. There are plenty of other price action trading strategies that can be used in a similar fashion to the Pin Bar setup. Our price action trading course Learn Forex and Pro Forex shows you how to generate an immediate income using techniques such as the Pin Bar price action trading strategy.

The best part about all this? Trading price action strategies like the pin bar should take you less than 30 minutes a day. How does that help the work/life balance?

Patrick Mahinge

Forex Trading Coach

Patrick Mahinge is a seasoned forex trading coach based in Kenya with over a decade of experience in financial markets.

Stay Updated with Forex Insights

Subscribe to our newsletter for expert trading tips, market analysis, and exclusive updates.

No spam. Unsubscribe anytime.

Related Articles

Contents

Patrick Mahinge

Patrick Mahinge is a seasoned forex trading coach based in Kenya with over a decade of experience in financial markets.