FTMO Review - Is FTMO Legit? | Full Prop Firm Review

FTMO is the world's largest prop firm offering up to $2M funding with proven track record and excellent support

Quick Overview

Performance Ratings

Funding Programs

| Program | Account Size | Challenge Fee | Profit Target | Max Drawdown | Profit Split |

|---|---|---|---|---|---|

| FTMO Challenge Standard two-phase evaluation program | $2,000,000 | $1,080 | 10% + 5% | 10% daily, 5% max | 70-90% |

| Swing Trading Extended timeframe for swing traders | $2,000,000 | $1,080 | 10% + 5% | 10% daily, 5% max | 70-90% |

| Aggressive Challenge High-profit target for experienced traders | $2,000,000 | $1,080 | 20% + 5% | 10% daily, 5% max | 70-90% |

Trading Conditions

Platforms & Instruments

Trading Rules

Pros & Cons

Pros

- Largest and most established prop firm

- Excellent payout reliability

- Multiple platform options

- Strong educational resources

- Transparent operations

- Multiple account sizes

- Proven track record

- Professional mobile app

Cons

- Strict time limits on challenges

- No weekend position holding

- No news trading allowed

- No hedging permitted

- $25 payout processing fee

- Lower profit splits initially

Kenya Accessibility

Trader Acceptance

Accepts Kenyan TradersTime Zone Compatibility

ExcellentLocal Support

LimitedLocal Payment Methods

Costs & Fees

| Account Size | Challenge Fee | Refundable |

|---|---|---|

| $10K | $155 | Yes |

| $25K | $250 | Yes |

| $50K | $345 | Yes |

| $100K | $540 | Yes |

| $200K | $1,080 | Yes |

You might have come across FTMO in your search for reliable prop firms in Kenya. It’s a name that’s been buzzing around the Kenyan forex and prop trading community, and the question on your mind, and rightly so, might be, “Is FTMO legit?”

But you’re in a little bit of luck today because I’ve done the legwork to bring you an in-depth look into FTMO, especially from a Kenyan trader’s perspective. I am going to shed light on FTMO’s operations including:

- The FTMO Challenge rules

- The Pros and Cons of FTMO compared to other popular prop firms

- FTMO Account types

What is FTMO?

- FTMO is a legit prop firm that provides talented traders the opportunity to trade with large capital by passing an evaluation program. They are not a scam, but rather offer a unique business model in the trading space.

FTMO is a proprietary trading firm that originated in the Czech Republic, and it’s been gaining traction globally for offering traders the opportunity to trade with its capital.

This legit prop firm operates on a challenge model, where you, the trader, must prove your skills in a simulated trading environment before getting access to the actual funds.

The FTMO Challenge is the first step in the process. It’s designed to assess your trading prowess under specific conditions.

You’re given a demo account with a set balance and have to reach a set profit target within a limited time while adhering to maximum loss rules. It’s a rigorous test, but it’s also fair.

The challenge ensures that only skilled traders manage the firm’s capital, which speaks volumes about FTMO’s commitment to risk management.

FTMO Pros and Cons

FTMO prop firm offers clear rewards but also carries risks. The firm needs to protect its capital, so funded traders must master risk management and maintain discipline. With the right abilities and mindset.

- Get funded account with large capital to maximize earning potential

- Keep up to 90% of your trading profits

- Educational resources and community support

- Gain prestige/credibility as a funded FTMO trader

- Highly challenging evaluation combines profit target with strict risk limits

- Funded accounts can be revoked for violation of rules

- Psychological pressure to perform with “house money”

- Lack of regulatory oversight as a prop firm

FTMO’s Legitimacy

Now, onto the big question: Is FTMO legit?

Based on numerous reviews, testimonials, and my own experience, FTMO stands out as a credible prop firm.

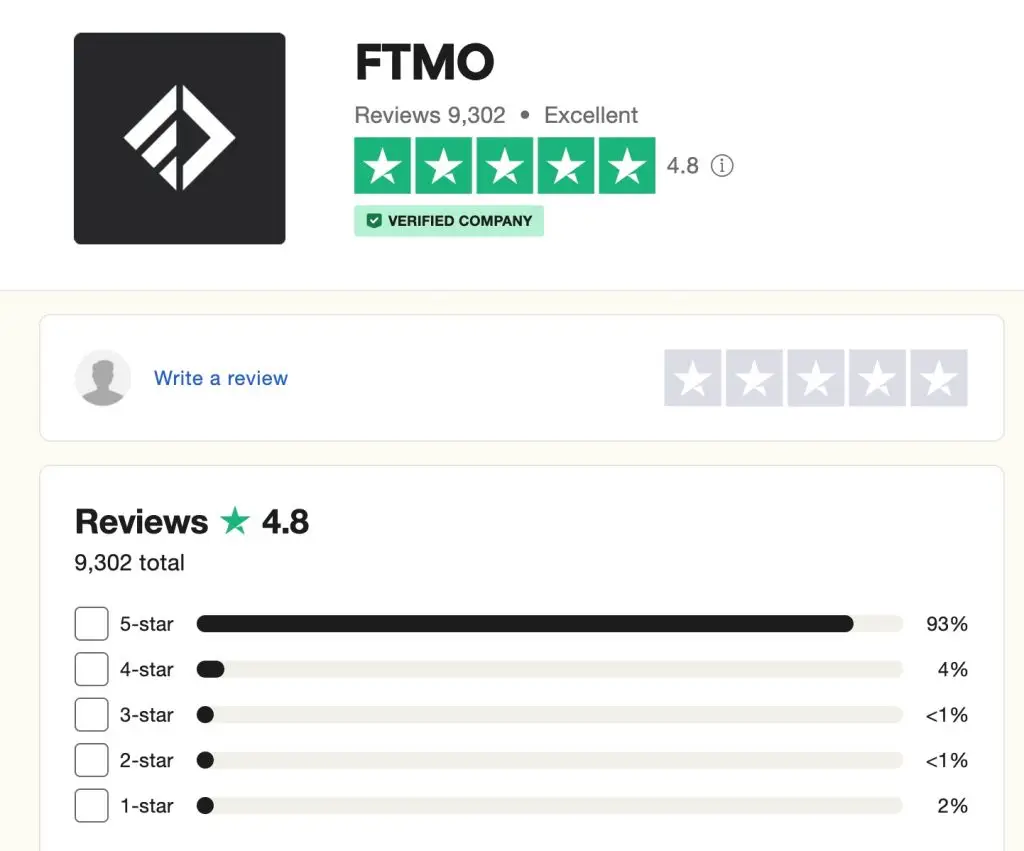

The firm has a long history of paying out to its traders, with a total of $29,000,000 paid out to traders on the platform. On TrustPilot, traders have shared positive experiences with FTMO, praising the firm for its efficient payout process and excellent support team. The firm has a score of 4.8 stars out of a possible 5.

They are transparent about their challenge rules and provide comprehensive support to their traders.

FTMO has also been positively featured in extensive trading journal publications such as Forbes, further cementing its legitimacy as one of the best prop firms in Kenya.

Is FTMO Regulated?

Here’s the thing: FTMO is not regulated.

Why?

Because it doesn’t operate as a broker. Instead, it’s a prop firm that provides its own funds to traders who prove their skills through its evaluation process. This might raise some eyebrows, but it’s important to remember that the lack of regulation doesn’t necessarily equate to a lack of legitimacy.

Regulatory bodies, such as the UK’s Financial Conduct Authority (FCA) or the Kenya Capital Markets Authority (CMA), oversee financial institutions to ensure they adhere to specific standards and practices, offering a layer of protection to investors.

Since FTMO operates as a proprietary trading firm and not a traditional broker or investment firm, its operational model falls outside the typical scope that regulatory bodies oversee.

FTMO Challenge Rules

The FTMO Challenge has two stages: the Challenge, and the Verification. Both have their own specific requirements, so here’s what you need to know to pass them.

- First is the Challenge. You’ll have unlimited trading days to hit a profit target of 10%. But don’t think it’s that simple — your losses are capped at 5% a day, and 10% overall. If you exceed either of these numbers, you’ve failed.

- Next is the Verification. The challenge here is easier. You’ll have unlimited trading days to hit a profit target of 5%. Again though, this comes with downsides — a max daily loss of 5%, and a max overall loss of 10%.

- Maximum Loss Limits: Your account’s equity must not decline beyond 90% of the initial balance at any point, considering both open and closed positions. This rule is crucial for managing risk and ensuring you’re trading within sustainable limits

If all this sounds intimidating, remember that it’s meant to be. Risk management and consistent profits are key skills every good trader should have.

From my experience and based on comprehensive discussions in reputable trading journals and forums, the consensus is that while challenging, FTMO’s rules are fair.

Here’s why:

- Transparency: FTMO is upfront about its rules and expectations. Before you even sign up, you have access to all the information you need to understand what will be required of you.

- Realistic Trading Environment: The rules set by FTMO mirror the risk management protocols you’d be expected to follow in a professional trading environment. They encourage discipline and a strategic approach to trading, which are invaluable skills in the Forex market.

- Support and Resources: FTMO doesn’t just set you up for the challenge and leave you to it. They offer a plethora of educational resources, tools, and even psychological coaching to help you succeed. This level of support plays a crucial role in the fairness of the challenge.

Once you’ve successfully navigated the FTMO Challenge, you’ll gain access to a funded trading account. You’re then expected to continue trading responsibly, adhering to the established risk management rules, and aiming for consistent profitability.

FTMO offers a scaling plan that increases your account balance as you demonstrate consistent success, alongside a profit split that rewards your trading achievements.

Passing the FTMO Challenge is a testament to your trading skill, discipline, and strategic insight. It opens up a world of possibilities for financial growth and professional development within the trading community.

FTMO Demo Account

As well as providing legitimacy to the platform itself, the FTMO demo account is the perfect tool to help you make that leap of faith — from practice trading to professional trading.

- Risk-Free Environment: With the FTMO demo account, you have the freedom to test different strategies without the fear of losing money. This shows that FTMO isn’t just after your profits but rather in your growth as a trader.

- Real Market Conditions: With the demo account, you’re given the same conditions as what real traders use. This level of transparency allows for a more authentic experience, further proving that they want to provide you with nothing but the best.

- Evaluation Preparation: The demo account is designed to prepare you for their challenge. By practicing in an environment similar to what you’ll be trading under if ever you pass, it puts you at a better position to meet their standards. It even shows how much they want to see you succeed.

- Educational Resources: On top of everything above, they also offer educational resources. As mentioned before, this again serves as proof of them wanting success for everyone who joins — not just on their end but on yours too.

The FTMO demo account is more than just a practice arena. It’s a testament to the platform’s dedication to your development as a trader.

By offering you this realistic and educational experience, FTMO sets itself apart as the real deal. Remember, the best traders are always learning new things. And with this demo account, you have a perfect opportunity to do so.

So take advantage of it! Refine your strategies! Get ready for the real thing!

Making an Informed Decision

Before you decide to embark on the FTMO challenge, consider the following steps to ensure you’re making an informed decision:

- Research: Dive into Forex trading forums, read reviews, and gather as much information as you can about FTMO and its operations.

- Understand the Model: Ensure you fully understand FTMO’s business model, the challenge process, and what’s expected of you as a trader.

- Risk Management: Remember, Forex trading involves significant risk. Only invest what you can afford to lose, and consider FTMO’s model as part of your broader trading strategy.

Is FTMO Scam or Legit?

Based on the available evidence, FTMO appears to be a legit platform that offers a unique opportunity for traders to access funded accounts. The company’s track record, transparent business model, and rigorous evaluation process suggest that it is a credible player in the Forex trading industry.

Based on the available evidence, FTMO appears to be a legit platform that offers a unique opportunity for traders to access funded accounts. The company’s track record, transparent business model, and rigorous evaluation process suggest that it is a credible player in the Forex trading industry.

Introduction

FTMO stands as the undisputed leader in the proprietary trading industry, having established itself as the gold standard for funded trading programs since 2015. Based in Prague, Czech Republic, FTMO has funded over 300,000 traders worldwide and distributed more than $100 million in profits, making it the most trusted and reliable prop firm for Kenyan traders seeking professional funding opportunities.

Company Background and Reputation

Industry Leadership

FTMO’s journey from a small Czech startup to the world’s largest prop trading firm is a testament to their commitment to trader success and operational excellence. The firm has consistently set industry standards for:

- Transparency: Clear rules and fee structures

- Reliability: Consistent payout processing

- Innovation: Cutting-edge technology and tools

- Education: Comprehensive trader development programs

- Compliance: Strong regulatory adherence

Global Recognition

Industry Awards and Recognition:

- 2023: Best Prop Trading Firm - Forex Awards

- 2022: Most Trusted Prop Firm - Trading Awards

- 2021: Innovation in Trader Funding - FinTech Awards

- 2020: Best Educational Resources - Trading Education Awards

Media Coverage:

- Featured in major financial publications

- Regular appearances at trading conferences

- Thought leadership in prop trading industry

- Academic partnerships with trading institutions

Comprehensive Program Analysis

FTMO Challenge (Standard Program)

The flagship FTMO Challenge represents the most popular route to funded trading, designed to identify consistently profitable traders through a rigorous two-phase evaluation.

Phase 1: FTMO Challenge (30 Days)

- Profit Target: 10% of account balance

- Maximum Drawdown: 10% daily, 5% overall

- Minimum Trading Days: 10 days

- Maximum Daily Loss: 5% of account balance

- Trading Rules: No weekend holding, no news trading

Phase 2: Verification (60 Days)

- Profit Target: 5% of account balance

- Maximum Drawdown: 10% daily, 5% overall

- Minimum Trading Days: 10 days

- Maximum Daily Loss: 5% of account balance

- Same Trading Rules: Consistency with Phase 1

Success Metrics:

- Pass Rate: 10-15% overall

- Average Completion Time: 45-60 days

- Trader Retention: 85% after first payout

- Scaling Opportunities: Up to $2M maximum

Swing Trading Program

Recognizing that not all profitable traders operate on short timeframes, FTMO introduced the Swing Trading program to accommodate longer-term trading strategies.

Extended Timeframes:

- Phase 1: 60 days (vs 30 days standard)

- Phase 2: 60 days (same as standard)

- Same Profit Targets: 10% + 5%

- Same Risk Parameters: Identical to standard program

Ideal for Kenyan Traders:

- Accommodates work schedules

- Reduces time pressure

- Allows for thorough analysis

- Suits part-time trading approach

Aggressive Challenge

For experienced traders seeking higher returns, the Aggressive Challenge offers increased profit targets with compressed timeframes.

High-Performance Requirements:

- Phase 1: 20% profit target in 15 days

- Phase 2: 5% profit target in 60 days

- Higher Risk: Requires exceptional skill

- Same Fees: No additional cost

Trading Conditions Analysis

Platform Diversity

FTMO’s multi-platform approach ensures traders can use their preferred trading environment:

- Most popular choice among Kenyan traders

- Extensive EA support

- Custom indicator compatibility

- Mobile trading capabilities

MetaTrader 5:

- Advanced order types

- Enhanced backtesting capabilities

- Economic calendar integration

- Superior mobile experience

cTrader:

- Professional-grade platform

- Advanced charting tools

- Level II pricing

- Algorithmic trading support

DXTrade:

- Web-based platform

- No download required

- Cross-device synchronization

- Institutional-grade features

Instrument Coverage

Forex Pairs (40+ pairs):

- All major pairs with tight spreads

- Popular minor pairs

- Selected exotic pairs

- Cryptocurrency pairs (Bitcoin, Ethereum)

Indices (15 global indices):

- US indices: S&P 500, NASDAQ, Dow Jones

- European indices: DAX, FTSE, CAC

- Asian indices: Nikkei, Hang Seng

Commodities (8 major commodities):

- Precious metals: Gold, Silver

- Energy: Crude Oil, Natural Gas

- Agricultural: Limited selection

Trading Restrictions and Rules

Prohibited Activities:

- ❌ Weekend position holding

- ❌ News trading (2 minutes before/after high-impact news)

- ❌ Hedging strategies

- ❌ Copy trading from external sources

- ❌ Account sharing

Permitted Activities:

- ✅ Scalping (with proper risk management)

- ✅ Expert Advisors (all types)

- ✅ Multiple position strategies

- ✅ Swing trading (in swing program)

- ✅ Day trading approaches

Kenya-Specific Considerations

Accessibility and Requirements

Entry Requirements for Kenyans:

- Valid government-issued ID

- Proof of address (utility bill or bank statement)

- Email verification

- Phone number verification

- No minimum age requirement (18+ implied)

Payment Methods:

- Skrill: Most popular among Kenyan traders

- PayPal: Available for Kenyan accounts

- Wise: Excellent exchange rates

- Bank Transfer: Direct to Kenyan banks

- Cryptocurrency: Bitcoin and Ethereum

Time Zone Advantages

Kenyan Time (EAT) Benefits:

- London Session: 10:00 AM - 7:00 PM EAT (perfect alignment)

- New York Session: 3:00 PM - 12:00 AM EAT (evening trading)

- Asian Session: 2:00 AM - 11:00 AM EAT (early morning)

Optimal Trading Schedule for Kenyans:

- Morning: 10:00 AM - 12:00 PM (London open volatility)

- Afternoon: 3:00 PM - 6:00 PM (NY-London overlap)

- Evening: 8:00 PM - 11:00 PM (NY session continuation)

Internet and Technology Requirements

Minimum Technical Requirements:

- Internet Speed: 10 Mbps download, 2 Mbps upload

- Latency: <150ms to FTMO servers

- Reliability: 99% uptime minimum

- Device: Windows/Mac computer or mobile device

Recommended Setup:

- Fiber Internet: 25+ Mbps for optimal performance

- VPS: Recommended for EA trading

- Backup Connection: Mobile data as failsafe

- UPS: Uninterrupted power supply

Risk Management Deep Dive

Drawdown Rules Explained

Daily Drawdown (5%):

- Calculated from daily starting equity

- Includes both floating and realized losses

- Resets at 5 PM EST daily

- Violation results in immediate account termination

Maximum Drawdown (10%):

- Calculated from initial account balance

- Cumulative loss limit throughout challenge

- Never resets during evaluation period

- Most common reason for challenge failure

Practical Example for $100K Account:

Starting Balance: $100,000

Daily Drawdown Limit: $5,000 (5%)

Maximum Drawdown Limit: $10,000 (10%)

Day 1: Start $100,000, can lose max $5,000

Day 2: Start $102,000 (if profitable), can lose max $5,100

Maximum loss from initial: Always $10,000Risk Management Strategies for Kenyans

Conservative Approach:

- Risk 1% per trade maximum

- Focus on high-probability setups

- Use proper position sizing

- Maintain detailed trading journal

Moderate Approach:

- Risk 1.5% per trade maximum

- Diversify across multiple pairs

- Use correlation analysis

- Implement trailing stops

Aggressive Approach (Not Recommended):

- Risk 2% per trade maximum

- Requires exceptional skill

- Higher failure probability

- Only for experienced traders

Payout Structure and Reliability

Profit Split Evolution

Progressive Profit Sharing:

- Initial: 70% trader, 30% FTMO

- After 4 payouts: 80% trader, 20% FTMO

- After 10 payouts: 90% trader, 10% FTMO

Payout Calculation Example:

Account Size: $100,000

Monthly Profit: $5,000

Trader Share (70%): $3,500

FTMO Share (30%): $1,500

Processing Fee: $25

Net Payout: $3,475Payout Processing

Timeline and Process:

- Request Submission: Via FTMO app or website

- Processing Time: 1-2 business days

- Payment Methods: Multiple options available

- Minimum Payout: $1 (no minimum restriction)

Payout Reliability Statistics:

- Success Rate: 99.9% successful payouts

- Average Processing Time: 24 hours

- Total Distributed: $100M+ to date

- Dispute Resolution: <1% of all payouts

Kenyan Payout Considerations

Currency Exchange:

- Payouts in USD

- Exchange rates apply for KES conversion

- Wise offers competitive rates

- Consider timing for optimal rates

Tax Implications:

- Consult Kenyan tax advisor

- May be subject to income tax

- Keep detailed records

- Consider tax-efficient strategies

Educational Resources and Support

FTMO Academy

Comprehensive Curriculum:

- Trading Fundamentals: Basic concepts and principles

- Technical Analysis: Chart patterns and indicators

- Risk Management: Position sizing and drawdown control

- Trading Psychology: Mental aspects of trading

- Platform Training: MT4/MT5 tutorials

Learning Formats:

- Video Courses: 50+ hours of content

- Written Articles: In-depth analysis pieces

- Webinars: Live educational sessions

- Case Studies: Real trading examples

- Interactive Quizzes: Knowledge assessment

Community and Networking

FTMO Community Features:

- Discord Server: 50,000+ active members

- Telegram Groups: Regional discussions

- Facebook Groups: Strategy sharing

- YouTube Channel: Regular educational content

- Blog: Market insights and analysis

Kenyan Trader Network:

- Dedicated East Africa channels

- Local meetups and events

- Mentorship opportunities

- Success story sharing

Technology and Innovation

FTMO Mobile App

Key Features:

- Account Management: Full control on mobile

- Performance Analytics: Detailed statistics

- Risk Monitoring: Real-time drawdown tracking

- Payout Requests: Instant withdrawal processing

- Educational Content: Learning on the go

User Experience:

- Rating: 4.8/5 on App Store

- Downloads: 500K+ installations

- Updates: Regular feature additions

- Support: Integrated help system

Advanced Analytics

Performance Metrics:

- Profit/Loss Analysis: Detailed P&L breakdown

- Risk Assessment: Drawdown and exposure analysis

- Trading Patterns: Behavioral insights

- Comparison Tools: Benchmark against other traders

Risk Management Tools:

- Position Size Calculator: Optimal lot sizing

- Drawdown Monitor: Real-time risk tracking

- Correlation Analysis: Portfolio diversification

- Economic Calendar: News impact assessment

Success Strategies for Kenyan Traders

Optimal Approach for FTMO Challenge

Phase 1 Strategy (30 Days):

- Week 1: Conservative trading, learn platform

- Week 2-3: Consistent daily profits, build confidence

- Week 4: Reach profit target, prepare for verification

Phase 2 Strategy (60 Days):

- Month 1: Steady performance, risk management focus

- Month 2: Achieve 5% target, demonstrate consistency

Common Pitfalls and Solutions

Frequent Mistakes:

- Overtrading: Taking too many positions

- Revenge Trading: Trying to recover losses quickly

- News Trading: Forgetting the 2-minute rule

- Weekend Holding: Leaving positions open

- Poor Risk Management: Exceeding daily loss limits

Solutions:

- Trading Plan: Develop and stick to strategy

- Risk Calculator: Use FTMO’s position sizing tool

- Economic Calendar: Monitor high-impact news

- Daily Review: Assess performance regularly

- Education: Continuously improve skills

Kenyan-Specific Success Tips

Local Considerations:

- Power Management: Use UPS during outages

- Internet Backup: Have mobile data ready

- Time Management: Plan around work schedule

- Currency Planning: Consider USD/KES fluctuations

- Tax Preparation: Maintain detailed records

Competitive Analysis

FTMO vs Major Competitors

vs. The5ers:

- ✅ More established and larger

- ✅ Better customer support

- ✅ Multiple platform options

- ✅ Stronger regulatory compliance

- ❌ Lower maximum funding ($2M vs $4M)

- ❌ Time pressure on challenges

- ❌ Stricter trading rules

vs. MyForexFunds:

- ✅ Better reputation and reliability

- ✅ More transparent operations

- ✅ Superior educational resources

- ✅ Professional mobile app

- ❌ Higher challenge fees

- ❌ More restrictive trading rules

vs. Apex Trader Funding:

- ✅ Forex focus vs futures

- ✅ Better international accessibility

- ✅ More comprehensive education

- ❌ Higher entry barriers

- ❌ More complex evaluation process

Unique Competitive Advantages

Market Leadership Benefits:

- Proven Track Record: 8+ years of operations

- Financial Stability: Strong balance sheet

- Regulatory Compliance: Multiple jurisdictions

- Technology Investment: Continuous platform improvement

- Community Size: Largest trader network

Cost-Benefit Analysis

Total Investment Calculation

$100K Challenge Example:

- Challenge Fee: $540

- Potential Monthly Earnings: $3,500-7,000

- ROI Timeline: 2-4 months

- Annual Potential: $42,000-84,000

Break-Even Analysis:

- Month 1: -$540 (challenge fee)

- Month 2: +$3,500 (first payout)

- Month 3: +$7,000 (second payout)

- Net Profit: $6,960 after 3 months

Hidden Costs Consideration

Additional Expenses:

- VPS Hosting: $30-50/month (optional)

- Trading Tools: $50-100/month (optional)

- Education: Free with FTMO

- Payout Fees: $25 per withdrawal

- Platform Costs: None

Total Monthly Operating Cost:

- Minimum: $25 (payout fee only)

- Typical: $75-125 (with tools)

- Professional: $150-200 (full setup)

Regulatory Compliance and Security

Legal Framework

Czech Republic Regulation:

- Licensed by Czech National Bank

- EU financial services compliance

- GDPR data protection compliance

- Regular regulatory audits

International Standards:

- Anti-money laundering procedures

- Know Your Customer requirements

- Segregated client funds

- Professional indemnity insurance

Security Measures

Data Protection:

- SSL encryption for all communications

- Two-factor authentication available

- Regular security audits

- GDPR compliant data handling

Financial Security:

- Segregated client accounts

- Tier 1 bank partnerships

- Professional liability insurance

- Regular financial audits

Future Outlook and Development

Industry Evolution

Prop Trading Trends:

- Increasing competition among firms

- Better terms for traders

- Technology advancement integration

- Regulatory framework development

FTMO’s Strategic Position:

- Market leader with strong moat

- Continuous innovation focus

- Trader-centric development

- Sustainable growth model

2024 Roadmap

Planned Developments:

- New Instruments: Stock and bond trading

- Platform Enhancement: Improved mobile experience

- Educational Expansion: Advanced courses

- Geographic Growth: New market entry

- Technology Innovation: AI-powered analytics

Risk Assessment and Warnings

Firm-Level Risks

Business Risks:

- Regulatory Changes: Potential operational impact

- Market Volatility: Extreme conditions effects

- Competition: Market share pressure

- Technology: Platform dependency risks

Mitigation Factors:

- Strong regulatory compliance

- Diversified revenue streams

- Experienced management team

- Robust technology infrastructure

Trader-Level Risks

Challenge Risks:

- Failure Rate: 85-90% don’t pass

- Time Pressure: 30-day deadline stress

- Rule Violations: Strict compliance required

- Market Conditions: Volatility impact

Success Factors:

- Proper preparation and education

- Conservative risk management

- Consistent trading approach

- Emotional discipline

Conclusion and Recommendations

FTMO represents the gold standard in proprietary trading, offering Kenyan traders the most reliable and professional path to funded trading. The firm’s combination of industry leadership, proven track record, comprehensive education, and excellent support makes it the top choice for serious traders seeking long-term success.

Key Strengths:

- Industry-leading reputation and reliability

- Comprehensive educational resources

- Multiple platform options

- Excellent customer support

- Transparent operations and fee structure

- Strong regulatory compliance

- Professional mobile application

Areas for Consideration:

- Strict time limits on challenges

- Trading restrictions (news, weekend, hedging)

- $25 payout processing fee

- High challenge difficulty (10-15% pass rate)

Final Recommendation: FTMO is highly recommended for dedicated Kenyan traders who can commit to the challenge requirements and demonstrate consistent profitability. The firm’s reputation, reliability, and comprehensive support system make it the safest choice for building a funded trading career.

Getting Started Guide:

- Education First: Complete FTMO Academy courses

- Demo Practice: Test strategies on demo accounts

- Start Small: Begin with $10K or $25K challenge

- Risk Management: Never exceed 1-2% risk per trade

- Community Engagement: Join FTMO Discord for support

- Patience and Discipline: Focus on consistency over quick profits

For Kenyan traders ready to take their trading career to the professional level, FTMO offers the most established and trustworthy platform for achieving funded trading success.

Ready to Start Trading with FTMO?

Join thousands of traders who have chosen FTMO for their prop trading journey.

Get Started with FTMO