A Forex trading course is designed to take you from being a novice, with no experience in the Forex markets, to becoming a consistent and profitable Forex trader. Learning how to trade isn’t going to happen in 2 days, it requires time and experience to master trading strategies. Please understand that a Forex trading course must be more than just an event across one weekend.

Let’s start with the obvious…

Why do you need a Forex trading course?

You may be thinking about learning how to trade Forex, or perhaps you may have already begun. It doesn’t seem that hard, you buy when the market is low, and you sell when the market is high. Sounds simple right? Wrong!

If you start trying to trade the Forex markets without any form of a Forex trading course or education, you’re likely to lose a lot of money very quickly. Remember as Benjamin Franklin once said ‘an investment in education always pays the highest interest’.

Learn how to trade the markets profitably by learning to trade with a Forex trading course. You will gain a concrete foundation in market direction and understanding of price action trading strategies. A good Forex trading course will also cover risk management or money management which is essential to keep you as protected as possible when you’re learning how to trade Forex.

What should be in a good Forex trading course?

1. Time to Learn How to Trade

A first-class Forex trading course should be accessible to you for a period of time, allowing you time to digest content and practice in the markets. You need to be able to refresh your knowledge as you grow as a trader.

2. Trading Strategies, with results

Let me be clear, learning how to trade Forex is not about finding the ‘Holy Grail’ trading system. If it sounds too good to be true, it probably is. A trading course should teach you a few trading strategies and an approach that have been traded over a period of time and in different market conditions. It should provide live results and back tested results of its trading strategies and be able to prove it has worked in the past and is working right now.

Forex trading course strategies should be rule based, so that you have predefined entry/exit criteria, or at least a couple to choose from, not just a ‘use your gut feeling’ approach. When you begin trading Forex you lack the experience to make decisions on ‘gut feeling’ but anyone at any experience level is fully capable to be given a set of predefined rules and follow them, step by step. Rule based strategies will help you stay disciplined when you’re learning how to trade as it’s just a matter of following a checklist, or set of rules.

3. Keep it Simple

A good Forex trading course should be simple; many beginners find this hard to comprehend. Many new traders make the mistake in thinking the flashier, more technical, more data the better it will work. This is not the case and a trading course should be able to get to the point and only teach you what works and what matters. A trading course should cover basic technical analysis, price action trading, and not be based on having loads of different indicators on your charts. You need to make sure that what you’re learning is based on price action, as it is the most important thing on the charts.

Do you want fries with that…the extra goodies.

When learning how to trade the more support the better. Find a Forex training course that gives you the entire package. The more insight you can get from an experienced professional trader the better. Trade alerts, daily market updates and a direct support line will ensure you continue to grow as a Forex trader and don’t miss money making opportunities.

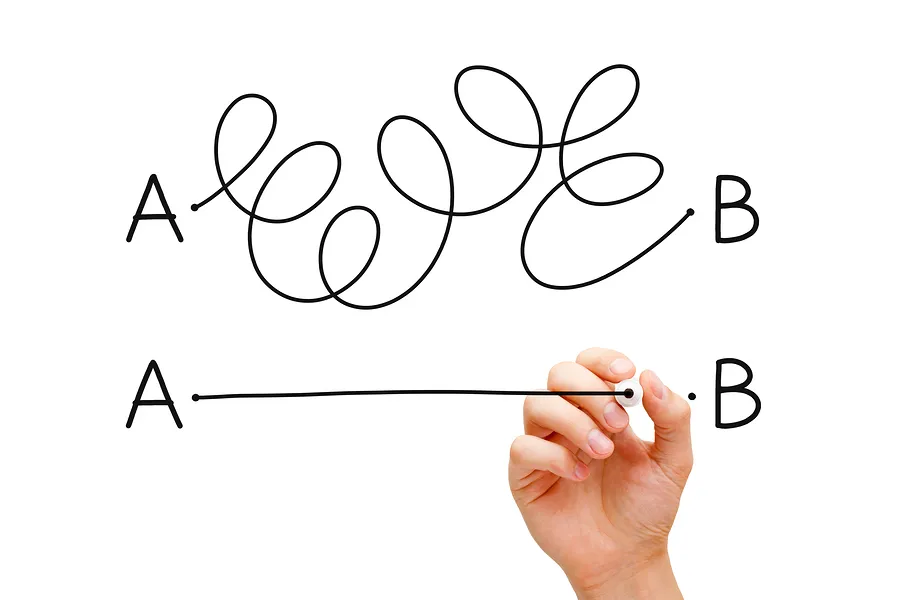

Understand that it’s not a race

You’ll hit that eureka moment when you understand that trading the markets profitably is not a race, or something that you can come first place in. You have to spend time in the markets to really become self-assured and consistent at what you’re doing.

Good Forex trading courses will make you aware of this, while some of the poorer ones will tell you it’s feasible to make 20% next month. Of course it’s feasible, the same as anything’s possible, but it’s a bit more probable that ‘pigs will fly’, than you making 20% growth on your trading account your very first month. If you’re simply profitable in your first month, you’re doing extremely well. A reputable Forex trading course will make you aware of this, and help you to grow as a trader so that you can become consistently profitable using price action trading methods.

Getting Forex Training is Important

Armed with the correct knowledge and strategies trading Forex can be very worthwhile. Like anything you need to learn how to do it before you start to do it and like anything that will cost money. The best thing, a Forex trading course doesn’t need to nor should it cost $5000 or anything absurd like that.

Companies charging thousands are more likely making money from selling courses, than trading profitably and those should be avoided. If you are ready to learn how to trade Forex learn more about our Forex training course, the amount of education, training and support you’ll get from it is off the charts. And at less than a cup of coffee a day, it’s also a steal. Click here to learn more.

How to Study the Market

For convenience sake, let’s say that you’re studying the EURO and your trading strategies are telling you that the prices will rise or rally, during a given time frame. You buy the EUR/USD pair or, technically speaking; you will simultaneously buy euros as the base currency and sell dollars.

So, you open up your trading platform, which is usually provided for you free by your online forex broker, and you then see that that the EUR/USD pair’s are trading at EUR/USD: 1.3242/45, for example. It is important to remember that the quote (1.3242) on the left, is the bit or “sell” price, which you obtain, when in USD’s when you sell EUR’s. the quote, on he right (1.3245), is used to obtain the ask or the “buy” price, which is what you have to pay in USD if you buy EUR.

Based on the belief that the market price for the EUR/USD pair will climb, you then enter a “buy position” in the market. Simply put, let’s assume that you’ve bought one lot at 1.3245 and as long as you sell the pair at a higher price; then you’ve made some money.

This seemingly complicated process is handled and calculated for you, via your broker’s software and trading platform. The charts and quotes board software should be in agreement with all currency sides.

Let’s have a look at this type of scenario, involving the USD/JPY currency pair. Remember, selling (“going short”) the currency pair implies selling the first base currency and then buying the second, quote currency. If you believe that the base currency (USD) will go down, relative to the quote (JPY) currency or, equivalently , you believe that the quote (JPY) currency will go up, relative to the (USD) base currency, then you sell or “go short”.

NOTE: while the Profit Calculations, on the Short-sell trade scenario below, may seem somewhat complicated if you’ve never been in the FOREX market before, trust us when we say, “this process is nearly seamless through your broker trade station (software). We’re just showing you this thought-process below so you can SEE how a PROFIT occurs even when. also view Forex Education.

Selling a Currency Pair. The current bid/ask price for USD/JPY is 105.26/105.30, meaning you can buy $1 US for 105.30 Japanese YEN or sell $1 US for 105.26 YEN. Suppose you decide that the US Dollar (USD) is overvalued against the YEN (JPY). To execute this strategy, you would sell Dollars (simultaneously buying YEN), and then wait for the exchange rate to rise.

So you make the trade: selling US $100,000 and purchasing 10,526,000 YEN. (Remember, at 1% margin, your initial margin deposit would be $1,000.). as you expected, USD/JPY falls to 104.26/104.30, meaning you can now buy $1 US for $104.30 Japanese YEN or sell $1 US for 104.26.

Since you’re short dollars (and are long YEN), you must now buy dollars and sell back the YEN to realize any profit. You buy US $100,000 at the current USD/JPY rate of 104.30, and receive 10,430,000 YEN. Since you originally bought(paid for) 10,526,000 YEN, your profit is 96,000 YEN.

To calculate your P&L in terms of US dollars, simply divide 96,000 by the current USD/JPY rate of 104.30. Total profit = US $920.42.

In a nutshell forex trading is really just that – foreign exchange currency trading, which today we know as Forex.

The forex market found popularity in the mid nineties and has gained in sophistication and momentum since then. It has become something of an immeasurable entity, with millions going online to trade on the forex market on an almost daily basis.

As a result, the forex market now trades billions of dollars, pounds, or whatever currency you care to name twenty-four hours a day, and the only time it’s closed is at the weekend.

However, worldwide time differences, mean that the shop, which is forex, is hardly ever closed. Therefore, the forex market is not a fixed, physical, entity.

And here is the difference between online currency trading and a physical trading market place like say, the New York Stock Exchange, The City of London, or the Tokyo Stock Exchange, where the traders are limited to the trading hours of these places.

In contrast, the world of the internet forex trading has no such limitations. The internet market permits one to trade from anywhere there happens to be an Internet connection; be it from home, an Internet cafe, or even from one’s work place, in the office.

There are numerous online currency trading platforms, from which to choose from, and it could be said that each online currency trader, has his/her favourite. For those new to forex trading, however, the choice should be made with care, and it is always advisable to try the various “demo” versions as fully as possible.

It must be said, thought that as well as having the possibility to make and take profit(s) from on-line currency trading, it is also possible to incur losses as well, so be careful and never spend more than you can easily afford to lose.

In Summary

Internet forex trading is purchasing one currency, for another, with the view of making a profit against the weakness of the currency one’s purchasing.

However, because the market can change within the wink of an eye – one has to have an agile mind, confidence, and to possess awareness of world and up to the minute financial affairs.

The online forex market can and will have sharp reactions to terrorist acts, for example and/or acts of God, for example hurricanes, which could upset crude oil supply and delivery.

And, although the markets now readily adjust to such affairs these days; the sudden drops and spikes, as a result, very often could and do, take one by surprise, nevertheless – even the most experienced of traders.

An average of $1.9 trillion is traded on Forex market daily, thus making it the world’s biggest market, and although anyone can now join in on online currency trading, the biggest players – day in day out, are the banks, which range from commercial to investment institutions as well as, registered, futures commission merchants.