HF Markets - Best Overall Copy Trading Platform in Kenya

Copy trading is a popular method of trading in Kenya where traders follow and copy the trades of successful traders in real-time. There are two ways to make money with copy trading: as a strategy provider or a follower.

As a strategy provider, you create a trading strategy and make it available for others to follow. When someone follows your strategy, you receive a portion of their profits as compensation. This can be a great way to earn extra income, especially if you have a successful track record of trading.

On the other hand, as a follower, you simply select a successful forex trader to copy and automatically mirror their trades. You make money if the trader you’re copying makes successful trades. This method is great for those who don’t have the time or expertise to analyze the market themselves.

However, it’s important to carefully select the traders you choose to follow, as not all traders are consistently profitable. It’s also important to consider the fees charged by the copy trading platform you use, as they may take a percentage of your profits.

Best Forex Copy Trading Brokers in Kenya

-

HF Markets

-

XM

-

Pepperstone

-

Exness

-

IC Markets Global/IC Social

-

JustMarkets

-

RoboForex

-

AvaTrade/AvaSocial

-

LiteFinance

-

OctaFx

-

Windsor Markets

Many forex brokers (such as HotForex and Exness) have integrated copy trading in their platforms. In return, they have reported a spike in the number of new client acquisition and retention of older ones. This is because copy trading features keep clients engaged and profitable for longer.

Read: HF Markets Review

Imagine trading on a platform that allows you to see what other traders are buying or selling? Would you ever want to leave?

A look at data obtained from LiteForex, another popular forex trading platform that offers social trading, reveals that social trading significantly reduces the learning curve for beginners and increases their profitability.

In fact, Ronald Mwiti, who was one of our forex training students, advanced to the list of top forex traders on HotFotrex by copying what other traders were doing.

Personally, I first heard of social trading a few years ago, but I never paid that much attention to it.

I have always wanted to do all the hard research and market analysis for myself. That way, if something went wrong with any of my trades, I would only have myself to hold responsible.

Then, I was making a lot of money using a forex robot (EA) that I had developed. I was doing so well that I thought I could give myself some time off to indulge in an expensive hobby. I had the money and the time. So, I decided to explore forex copy trading.

And that’s exactly what I did. My verdict? Forex copy trading is completely worth it, especially if you are a new trader.

Best Forex Copy Trading Platforms in Kenya

There are a lot of copy trading platforms and brokers in the world. But not all of them are created equal. I easily realized this as I was doing my copy trading experiments.

I signed up for more than 20 of the most popular forex brokers that offer copy trading. Some of them were complete jokes with zero iota of customer service. Others required huge starting capital that would not be ideal for most beginner forex traders. Others made the sign up and account verification process a nightmare.

But among all the rubble, I identified 5 of the best forex copy trading services in Kenya.

Here’s the list of the 5 best copy trading platforms in Kenya:

-

eToro

-

LiteForex

-

Exness

-

SuperForex

So, What is Forex Copy Trading?

Forex copy trading is an approach to trading that allows you to see and copy what other traders are doing.

Traditionally, successful traders guarded their positions and trading strategies fiercely. In fact, way before the advent of the internet, only a few individuals knew about online forex trading.

When online trading was popularised a few years ago, the only way you could trade forex was through technical or fundamental analysis. Although there is nothing wrong with technical and fundamental analysis, they are both complicated strategies that confuse most new forex traders.

But things have gradually changed over the past few years.

The world has slowly but surely become a small village. Social networks have made communicating with friends, relatives, and strangers just a click or a tap away.

You can think of forex copy trading and social forex as the biggest leap in social media for traders.

Such trading combines aspect of social media such as updates, following, and friending, with the core aspects of forex. Unlike with technical or fundamental analysis, trading decisions are crowdsourced within the community.

In forex copy trading, information and trading signals are generated by other users on the trading platform, therefore removing the need for newbies to learn complicated forex analyses strategies.

And just like in social media, information is shared in real time, allowing new investors to watch and replicate the trading decisions of experts.

How Does Forex Copy Trading Work?

To help you understand forex social trading better, let us take a hypothetical example of what would happen on social media, say Facebook.

If you learn from a Facebook friend of yours that a company is about to release or acquire a new startup, this is certainly bound to skyrocket the shares of that company, which means that the best time to get in on the stock is now.

Still on Facebook, another friend mentions a managerial conflict is brewing in another company. This will certainly dip the shares of the company. If you had bought their shares, you’ll most probably want to dump them now.

I hope you get the picture.

But what you get on Facebook might not be reliable. And Facebook is not specialized for such information.

Now, imagine being on a platform that only shares information on forex trading, in real time?

But the beauty of social trading sites lies not only in the information provided, but also in the fact that you can see the historical trading data of the person providing the information. You can therefore tell how reliable they are.

You can get information on different other places such as Google+, Twitter, forex forums or from a premium forex signal service, but there is no way to prove the legitimacy of such information.

I’d therefore recommend you to use social trading sites, if you intend to trade using third-party generated information.

Getting Started With Forex Copy Trading in Kenya

1. Sign up on a social trading platform

You’ll need to sign up on a social trading platform. There are quite a number of them that have sprout up in the past few years. However, the most popular and reliable ones included

2. Follow a Successful Forex Trader

Once you have signed up in a social trading platform, take time to explore through the different expert profiles on the platform.

If you find a trader that pleases you, and is constantly profitable, you can choose to follow him or her.

This way, you’ll see his trades, comments, and more of his activity at all times. Following an expert helps you learn from him, and if you do not understand what he is saying, you can always ask him to clarify for you.

There is a lot that goes into choosing a trader to follow. However, I’d recommend that you follow a trader who communicates with the community on the platform. By doing this, you’ll be able to learn a lot faster than you’d otherwise do.

Of course, if the community is a large one like the one in eToro, the trader might not be able to answer all the questions and comments. Don’t act like an entitled aristocrat.

3. Private Messaging

A truly social trading platform puts social interaction features upfront. Many of the social trading platforms that I mentioned above allow users to exchange messages via a private inboxes.

The social features mirror those of Facebook, Twitter, and LinkedIn.

Make use of these social features. There is a reason why they are there. Ask questions where you don’t understand. Like with any other social media platform, the more you are active in there, the more you’ll gain. In short, don’t be an introvert.

Is Forex Copy Trading Profitable?

It is good to be sceptical, especially where money is involved. So, how plausible is it for a beginner trader with zero experience in trading to register on a social trading platform, and make money from just copying other traders?

Yes. Social trading increases your chances of profitability. You’ll be more positioned to make money with social trading than with conventional trading.

However, while social trading is fairly easy to implement, it is not without its drawbacks.

-

Many of the social trading platforms will allow anyone to become a ‘leader’ and have their trades available for others to copy. So, how do you choose the leader to follow? This is a topic for another day, but in essence, you want to copy traders who have a history of successful trading.

-

Social trading fosters a culture of laziness and lack of responsibility. To become a successful investor in any market, you have to

Would you like to try a trading on a social trading platform? Open a demo account on etoro.

Important Social Trading Tips

While social trading can be a fun and potentially profitable experience, it’s always important to learn more about how the process and concept works. Here are some tips for successful social trading:

-

Understand which social trading platform is the right choice for you. There are several prolific social trading platforms available to investors – such as EToro, Currensee and Zulutrade. While they all broadly work along the same lines, there are strong differences between them that could affect you. Some of these differences include the ways in which fees are calculated, what the minimum deposit needs to be and the levels of experience that “guru” traders need to have become ordinary investors can follow them.

-

Social trading may not require much technical trading or investing knowledge, but it is still important to devise a clear strategy on how you will allocate your trading funds. The high levels of transparency means you should be able to find a good trader to copy – this should be someone who has a long term history of generating profits.

-

If you’re totally new to social trading, you should start with a practice account, as offered by the major social trading sites. The key to using a dummy account to practice copy trading is to use the same amount of capital as you would if it were your real money. Once your dummy account starts to turn a regular profit you can then start trading with your real capital.

-

Risk management and allocating your capital is key with social trading. You need to remember that the more traders you elect to copy, the more trades the system will be making on your behalf and so the more capital you will need to have available. One big mistake that rookie social traders make is in not having sufficient capital for all the trades that their chosen traders make. Investigating a potential traders past will give you an indication of how many trades they typically have open at any given time.

-

When picking a social trader to copy, aim to find one who fits your own risk and trading profile. Traders vary wildly in their approaches and strategies – you can find out more about a traders style by checking their profile and their trading history. Do they have more smaller, consistent winning trades or are there a few huge gains with many losses?

-

How many followers does the social trader have? While it cannot be used as the definitive indicator, a trader with many live followers (ie those who are actively following the trader with real capital) is a good indicator of how good that trader might be.

-

Check the drawdown for each trader you are considering copying – how many times have their trading account been in deficit?

-

If you’re opting to follow a number of traders, make sure you analyze their trading styles and what they are their trading. The whole point of selecting more than one trader is to diversify risk – but if they are trading the same things at the same time, using the same strategy you’re not going to get much diversification with your trading results.

-

Practice sound risk management. As always with any investment type, good risk management will help preserve your capital and make sure that it grows as you practice social trading. Good risk management means trading with only a comfortable amount of capital and diversifying that capital sensibly.

Frequently Asked Questions About Forex Social Trading

It is very difficult and rare to make consistently good returns in the world of trading and investments. Very few traders, even seemingly professional ones are able to deliver robust growth over a long period of time.

To make the best possible returns with social trading, it is important to find those few traders who are able to do just that.

Thankfully, most social trading platforms are extremely transparent and offer many tools for investors to hunt down those profitable traders who can help maximise your returns. Sites like Etoro for example allow you to analyze each trade a trader has made, and you can find the percentage returns they have generated historically. It cuts down the time needed to shortlist the best traders – it’s always worth keeping in mind that just because a trader generated a profit last year, or over the last few years – that they will do so again.

Popular Social Trading Questions & Answers

Because social trading is such a new and exciting concept, a lot of people have several questions about it. It seems almost too good to be true at times, but done right social trading offers exactly what it says on the tin – a chance to trade alongside the experts, and achieve the same investment returns as them.

Here are some popular questions that people have about social trading:

Why Do Social Trading?

The simplicity and potency of social trading is why it has such appeal to many novice, would be investors. With social trading there is no need at all to understand the mechanics of the market, or investment basics and principals.

There is no need to learn ratios and analyze market conditions or which way one currency is likely to go against another. With social trading, the investor only has to research a good trader that they trust leaving their capital with, and allow that trader to grow their own account.

The Logistics Of Social Trading – How Do They Operate?

Once you open your account with a social trading network, you effectively agree to let the nominated broker associated to that site to execute trades on your behalf.

After the account has been funded, you simply select a professional trader to copy and the system will automatically open and close trades for you – exactly when the expert trader does. So, you should in theory make the exact same profit as the trader who you’re copying. In reality this does not always happen to the dollar – due to a concept called slippage.

Slippage is the difference in price that is caused by a time delay between placing your order and having it executed. Prices move very fast in markets, and so you may not always get the same price as the trader you’re copying.

Even so, slippage should not cause much of a difference in your ultimate profit or loss. There are also fail safes in most social trading networks – so if the price moves too far away from your expert traders, the trade will be cancelled.

-

Do I Have To Pay Money To Trade Socially – The main social trading networks are free to join, and to start trading with. Normally, the actual cost to you as an investor will be the “spread” (the difference between a trades bid and ask price) and depending on the social trading site there may be a success fee on trades you make a profit on.

-

What Amount Of Capital Would I Need To Start Social Trading? Every social trading network has its own minimum level of deposit. In some, it can be as little as fifty dollars, but in some it is significantly higher. To make a real go of social trading it is recommended you start with at least $2,000.

-

Do I Need To Have Any Financial Or Trading Knowledge? While it is always good to have some financial and basic trading literacy, you need not know all that much about the technicals. The expert trader you select will be making the trading decisions for you.

-

Could I Lose Any Or All Of My Capital? As with all investments, there is no guarantee of profit, or that you will not lose a part or all of your capital. Trading is always risky, so you should only allocate that amount of capital that you are comfortable investing.

-

How Long Are Trades Open For Typically? This will vary greatly depending on the trader who trades for you. Each trader will have a unique trading method and style, and the time your trades are open for will largely depend on your traders strategy. Some trades may open and close in a matter of hours, while others may stay open for weeks or even months. You can always check the history of a trader to see how long on average their trades are open for.

Using Basic Financial Ratios to Evaluate Trading Systems

When we browse through the leader boards and performance charts of traders on copy trading platforms, we are presented with how much return on investment (ROI) a trader made since they started trading or how many “pips” they made in the last month. While ROI and “Pips” can be used to measure the nominal performance of two traders, or among hundreds of traders, these metrics can also be very misleading to interpret for novice investors.

This is because, when you see a 30% ROI in a month, it does not say what kind of risks the trader or the system took in order to generate that reward or profit. Furthermore, one of the alarming aspects of the copy trading industry is the tendency of traders to develop systems that try to maximize the “win rate” over long-term sustainable ROI!

In order to evaluate the integrity and long-term prospects of a trader or their trading system, it is recommended that copy trading investors apply to following basic financial ratios:

Forex Financial Ratio to Consider # 1 – Profit Factor

If you think a system with a win rate of 98% will certainly make profits in the long run, this might not be your lucky day! There are hundreds of examples in the Forex copy trading circuit where a trader had almost 100% win rate for months, even years, then suddenly the system failed and investors lost everything.

You see, if a trader makes 100 trades, wins $1 per trade on 98 trades then lose $100 on the rest of the two trades; you got a profit of $98 and loss of $200! It is like a mini Black Swan (no, not the movie) event, but these happen all the time.

Hence, you need to keep an eye on the profit factor of the system. As long as the profit factor is above 1, it means the system made more money from all its winners compared to the sum of all losses. While a profit factor of 1+ is a sign of profitability, you should always consider investing in systems with a profit factor above 1.5, or even 2.

Forex Financial Ratio to Consider # 2 – Average Win Vs. Average Loss

The problem with profit factor is that while it is an excellent metric to sort out winning strategies and systems, it is vulnerable to the fact that when a flawed system keeps winning with a good win rate (i.e. 95% win rate) the profit factor will be above 1. Therefore, you may not be able to distinguish the flawed systems based on profit factor alone.

On the other hand, if you consider the average win and average loss of a system, it can reveal how the trader or his system actually trades the market. If the average win (pips or actual dollar figure) is higher than average loss, it meets the criteria of a genuinely good system.

For example, if the average win of a system is $100 and the average loss is $120, you can immediately tell that this system needs to have a win rate over 50% just to break even. Nevertheless, at 60% win rate, this system will produce (60 x $100) $6,000 in profit and (40 x $120) = $4,800 loss, or a $1,200 net profit over 100 trades. Therefore, based on this example, you should plug in the average win and average loss of a system along with the win rate to find the system will be profitable in the long run over 100s of trades.

Forex Financial Ratio to Consider # 3 – Sharpe Ratio

The Sharpe ratio is the holy grail of evaluating performance of a trader or system. The inventor actually won Nobel Prize for his work in economics. Anyway, the Sharpe ratio basically measures the risk adjusted return of a system. Hence, it can show you how well the trader is gaining profits based on the risks he is taking.

As a high reward can be achieved by taking insane risks, it is always a good idea to measure the performance of a system after discounting the risks. The Sharpe ratio compares the average rate of return of the system by comparing it to the risk free return you can get. For example, investing in Forex has risks, but putting your money in a government run savings scheme or bond has hardly any system risks. Therefore, with Sharpe ratio will help you understand what are the excess risks to the system takes in order to provide the extra return.

There are plenty of resources online to explore further regarding how the Sharpe ratio is calculated. You actually do not need to learn to do this yourself, as the most good trading platform will provide this ratio to you for free. But, if you fancy a bit of math time, head over to Investopedia and have a feast! What you need to know is that you should never consider investing in a system with a negative Sharpe ratio as it means you are better off investing in a risk-free asset like US T-Bill.

In fact, only consider investing in copy trading systems that has a Sharpe ratio of 0.5 to 1, or even better.

Conclusion

While the three financial ratios discussed here should help you get a basic understanding of how a copy trading system is generating profits, you should explore further on this subject. However, the important thing to remember that no single ratio will provide you the complete picture about a system. This is because we have different risk appetite. Some of us are comfortable seeing a 20% drawdown where others may lose their temper with a mere 5% drawdown. Hence, you have to combine various ratios to reach your own conclusions about a system based on your personal risk tolerance.

Best Social Trading Platforms

1. Etoro

Two brothers, Yoni Assia and Ronen Assia, collaborated with David Ring to develop one of the first social trading platforms in 2007 and founded eToro.com. Initially, eToro.com was launched as a financial trading platform in order to bring top class financial service to the masses.

The first product was download only and it had graphic trading visualization aids for traders. Later, eToro.com diversified its product portfolio and introduced more professional grade trading applications. Such as the “Expert Mode” and a cloud based trading platform called the “WebTrader.” eToro revolutionized the social trading concept by introducing its OpenBook social investment platform in 2010. The key feature of the OpenBook was the “Copy-Tradng” feature, which enabled investors to view, follow, and copy eToro network’s top traders.

Incorporated in Tel Aviv, Israel, eToro.com’s main research and development facility is still located there. Besides is office in Israel, eToro.com has registered offices in the United Kingdom, Australia, and Cyprus. The company employs around 250 people around the world.

eToro’s primary brokering services are provided by eToro (Europe) Ltd. It is registered as a Cypriot Investment Firm (CIF) (company registration number: HE200585) regulated by the Cypriot Securities & Exchange Commission (CySEC) under license number 109/10. eToro (Europe) Ltd. is also obligated to operate under the Markets in Financial Instruments Directive (MiFID).

eToro.com Review: Trading Services

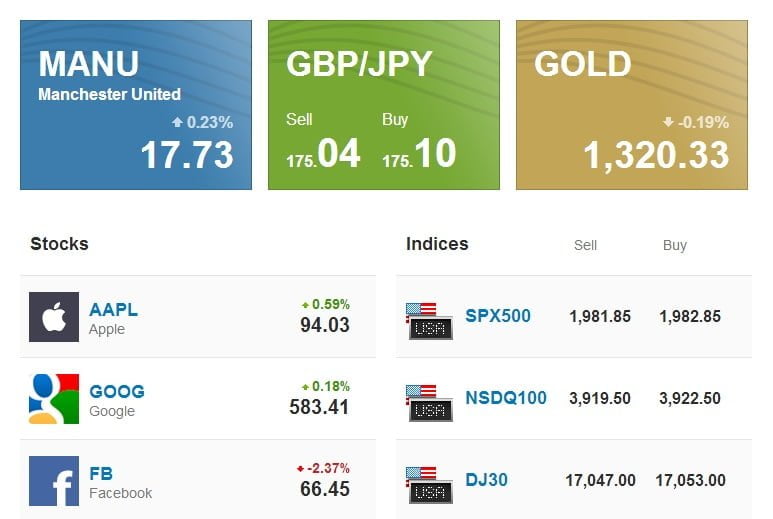

eToro.com currently offers its customers access to trading Stocks, Currencies, Commodities and various other Indices. While eToro provides live market price feed for most of its trading instruments, the stock price quotes are provided by Xignite, a third party financial market data provider.

“eToro is the first global marketplace for people to trade currencies, commodities, indices and stocks online in a simple, transparent, and more enjoyable way,” says eToro’s website.

Besides offering trading services, eToro.com also offers specialized social trading services via its OpenBook platform. It hosts a live stream of trading data from its traders. The data are made available on the eToro OpenBook platform for other investors.

In fact, each user’s trading performance is automatically uploaded and presented in their eToro OpenBook profile, where other users can then view their trading statistics. Each investor/trader can then set their accounts to copy any other trader/investor on the network. Under this system, eToro trading platform duplicates each trade made by the copied investor in the copier’s account.

The spreads charged by eToro.com depends the liquidity of the pair. With highly liquid pairs, such as the EUR/USD, it only charges two pips spread. Besides offering low spreads, eToro.com offers 400:1 leverage to its users.

In addition, traders can utilize demo account to try out their own trading skills as well as copy trades from other traders to evaluate before copying on their live account.

eToro.com Pros and Cons

Pros

-

Well regulated by Cypriot Securities & Exchange Commission (CySEC)

-

Ample traders are available on the social trading platform to suit different type of investors

-

The minimum deposit requirement is very low, users only need $50 to open a live account

Cons

-

As like any other copy trading platform eToro’s platform may lag and the slippage may pose a problem

-

eToro does not provide MetaTrader 4 platform for traders which means additional learning curve

eToro.com Review: Customer Support

eToro.com offers customer support to its users via various channels. Besides providing phone support from its United Kingdom, Cyprus and Australian corporate offices, eToro.com has online chat option and a fully staffed online help desk, which can be reached via email as well.

eToro.com Review: Trading Platforms

Since eToro.com is trying to offer a disruptive socially oriented trading platform for participating in the global markets, it does not provide any “downloadable” trading software.

In fact, unlike most brokers, it does not offer the popular MetaTrader 4 platform to its users. Instead, eToro.com takes pride in developing its own cloud based manual trading platform, the WebTrader.

eToro.com also eliminates the need for over-complex charts and indicators and presents a social trading alternative called the eToro OpenBook. In contrast to using trading algorithm based “trading signals” eToro offers its users “crowd generated data” that aggregate a vast number of real trades to generate buy or sell signals. eToro has developed a Social Alert mobile app to deliver this crowd generated signals to users.

Social Trading with eToro.com

eToro.com has developed a unique social trading platform where 3 million investors offer their portfolio to be copied by other investors. Its CopyTrader ™ is a groundbreaking system that enables you to copy other investors automatically and manage your copy trading activity just as you would manage investments in any other market.

eToro.com offers a people discovery tool that allows investors with a search mechanism that makes it easy to find traders according to specified criteria. For example, by searching with lowest drawdown or highest profits will list traders with those attributes.

Also, eToro.com’s Top Taders’ Insights widget provides investors with data from its top 1,000 profitable traders. This widget displays the top 10 most traded instruments, along with a breakdown into buy and sell positions, giving you an overall measurement of the sentiment among our most successful investors.

2. ZuluTrade

ZuluTrade.com was founded in 2007 by Leon Yohai and it is one of the most prominent social trading platforms in the Forex industry. In fact, ZuluTrade was one of the first copy trading platforms for the general public.

It was “created in response to the non-existence of a web-based platforms that could audit traders globally and at the same time; enable traders to share their knowledge with people interested in their strategies,” says ZuluTrade.com.

Since ZuluTrade.com is not a broker itself, it does not require traditional regulatory oversight. However, it is registered as a corporation in Wilmington, Delaware. Also, ZuluTrade.com is NFA registered as a financial corporation and they are a member of U.S. Commodity Futures Trading Commission (CFTC) .

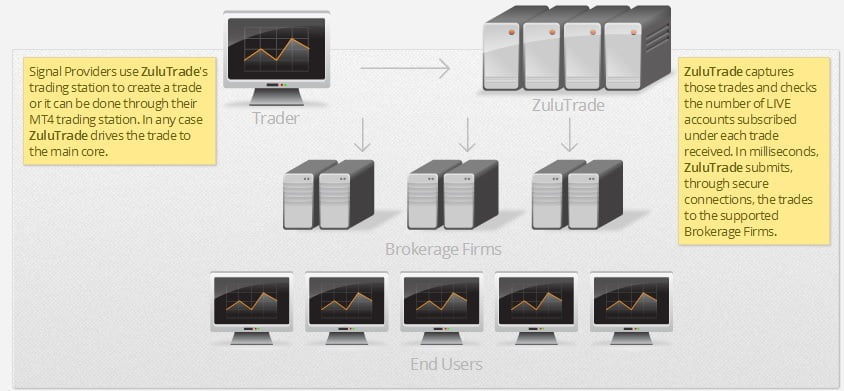

ZuluTrade.com facilitates the platform where investors can subscribe to a trader, and the trader executes the orders via a third party broker. Once the order is executed, ZuluTrade.com copies the trade and execute it on the customer account. Hence, the trader’s performance is reflected in its customer’s account.

ZuluTrade.com Review: Trading Services

The vision of ZuluTrade.com is to:

The vision of ZuluTrade.com is to:

“offer an open environment, where traders can globally connect to any trading platform and share their knowledge, in addition to receiving a commission every time someone uses their expertise to a live trade.”

ZuluTrade.com provides a social trading platform where customers can choose and pick their preferred traders based on track record and copy their trades. ZuluTrade.com currently supports a range of brokers who offers MetaTrader trading platform.

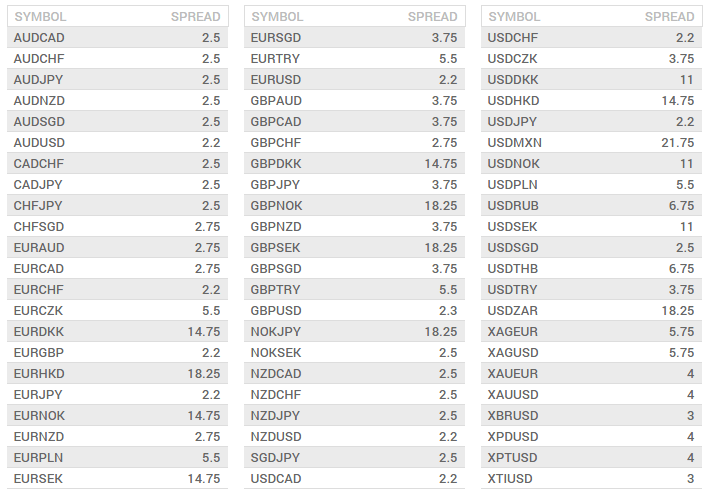

It developed from scratch the API for the MT4 platform since Metaquotes did not provide an API. The spreads charged by ZuluTrade.com depends on each individual investor’s broker. Investors are particularly advised to watch the spreads offered by their brokers because often the traders put tight stop loss to minimize any losses.

If the trader’s account has lower spreads, and the investor’s broker has higher spreads with few pips of difference can result in a lost trade on the investor’s account due to higher bid/ask difference.

ZuluTrade.com traders can build their track record with demo accounts. However, they also have options to trade their live accounts to demonstrate confidence about their own trading ability and performance.

ZuluTrade.com also has a 30-day demo account for potential investors who wants to try out traders before deciding to follow them with real money.

ZuluTrade.com Pros and Cons

Pros

-

Well regulated as an NFA and CFTC member

-

Ample number of traders are available to suit different type of investors

-

ZuluRank ranks traders analyzing different factors, such as the amount of trading activity, the drawdown of each trade and the entire profit and loss (PnL)

-

No payout to traders if they end the month with a loss

Cons

-

The vast amount of traders makes it difficult to pick the right trader

-

Slippage can be a problem at times due to lag between ZuluTrade.com and Broker

ZuluTrade.com Review: Customer Support

ZuluTrade.com has comprehensive means to offer customer support. Besides email and online chat support 24 hours a day and 7 days a week, customers can call to avail support. ZuluTrade.com currently list numbers for United Kingdom, Germany, Russia, Spain, Greece, United States, Mexico, Colombia, Japan, China and Australia.

It also has a central support hotline for customers from other countries. Along with the traditional customer support channels, ZuluTrade.com has a dedicated forum, where both traders and investors can discuss about their concerns as well as share knowledge about social trading in a friendly but moderated environment.

ZuluTrade.com Review: Trading Platforms

ZuluTrade.com offers its copy trading service to 60+ Forex brokers who utilize MetaTrader 4 platform to execute trades. However, it also has client side apps available for iPhone, iPads, Android smartphones, BlackBerry Playbook and Z10 app.

ZuluTrade.com subsequently launched their Windows phone app. ZuluTrade.com customers can login to the web interface or the phone/tablet app to monitor the progress of their account.

ZuluTrade.com also offers apps for the trader to executing trades on the go. The traders have an option to execute trades directly from the ZuluTrade.com web interface, app or by linking broker’s MT4 account via API.

Investors/customers can also execute manual trades on their accounts while it is connected to the ZuluTrade.com platform, like any normal MetaTrader 4 account. In fact, if an investor chooses to close or modify any trades opened by the traders, he or she can easily do so.

3. Tradeo

Based in Tel Aviv, Israel, Tradeo is a social trading platform developed by Hogg Capital Investments Ltd. It is backed by some of the major venture capital firms in the industry and offers its social trading as well as a brokerage service to the international market. The mother company of Tradeo, Hogg Capital Investment Ltd is a registered company in Malta and it is regulated by the Malta Financial Services Authority (MFSA).

Tradeo is registered with the MFSA as a category 2 license that allow/authorize it to provide investment service to the general public and hold and/or control clients funds or assets. However, having a category 2 license does not allow Tradeo to trade or deal. In addition, Tradeo is not authorized to act as an underwriter based on financial regulations in Malta.

Tradeo Review: Trading Services

Tradeo is a unique social trading platform as it offers its own Forex brokerage service instead of acting as a mere social trading platform for other brokers. For example, with services like ZuluTrade and MirrorTrader, copy trading investors have to sign up with one of the partner brokers then link their accounts. With Tradeo, however, everything is owned and operated by the same company that allows its customers to enjoy a better integrated and seamless copy trading experience.

Tradeo offers two types of instruments, Forex pairs and select CFDs. With Forex, Tradeo customers can copy trades from other traders on around 65+ pairs. On the other hand, with CFDs, Tradeo offers a few select instruments such as major Indices like DutchCash, UK100Cash, Euro50Cash etc.

As far as spreads are concerned, Tradeo’s pricing for Forex pairs seems to on par with other major Forex brokers. For example, the fixed spread for EURUSD is 2.2, where more exotic pairs like GBPNZD have a spread of 3.75. In comparison, Tradeo’s spread for CFDs are a bit high, as high as 5% on HKCash. In contrast, Tradeo offers a very good level of leverage, up to 200:1 to all customers.

While it is free to open an account with Tradeo, the minimum deposit requirement is set at $100, which is reasonable. Tradeo also offers standard Demo accounts for paper trading the platform for new investors who wants to get familiar with the interface before starting trading a live account.

Tradeo Review Pros and Cons

Pros

-

The minimum deposit requirement is only $100

-

Offers very competitive leverage, 200:1 on Forex pairs

-

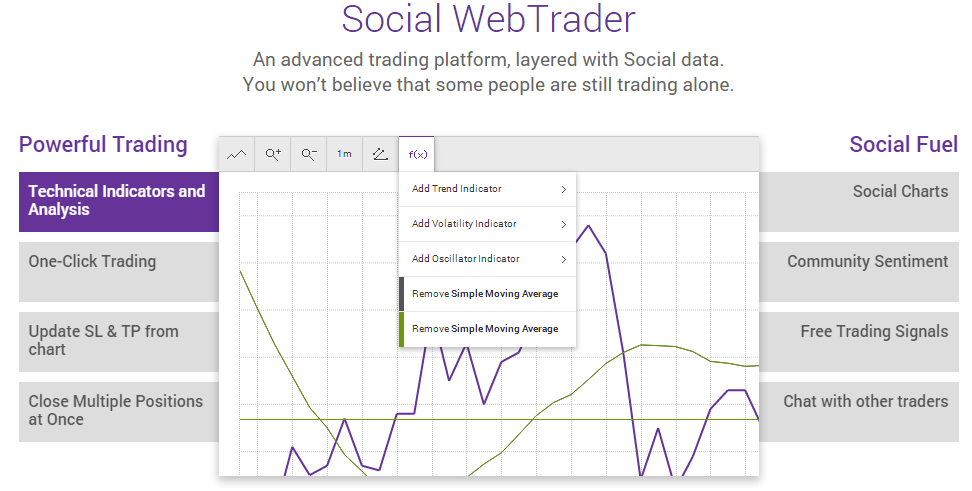

Built-in chat support in the Social WebTrader

Cons

-

Lacks regulatory oversight by major western financial regulators, the company is registered and regulated in Malta

-

International customers have to call overseas as phone support is only available in the UK and France

Tradeo Review: Customer Support

Tradeo offers a range of channels for offering customer support. Our research for this review revealed that besides offering phone support via dedicated numbers in the United Kingdom (+442035140493) and France (+33182882972), Tradeo also offers live chat within its Social WebTrader platform. Furthermore, Tradeo customers can visit its support system as well as avail customer service by sending e-mails to support@tradeo.com .

Tradeo Review: Trading Platforms

One of the unique aspects of Tradeo is that the company does not rely on third party software platforms like MetaTrader or cTrader. Instead, Tradeo software engineers have spent three years developing its feature rich proprietary social trading platform called the Social WebTrader. Since the Social WebTrader is a cloud-based platform, you do not need to download or install any additional software to enjoy the Tradeo services. You can easy copy trade from any computer using a standard web browser.

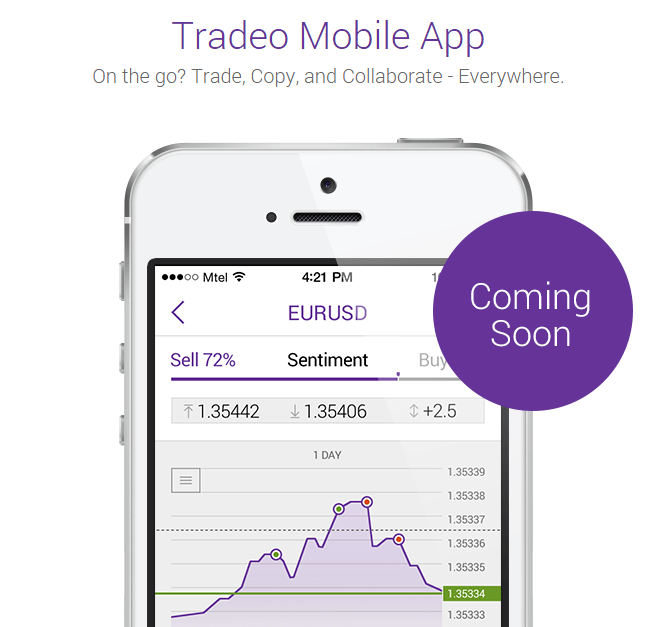

Mobile Platform

At the time of writing this Review (Nov 6, 2014), Tradeo was working on a mobile app that will allow its customers to connect and trade on the go. However, we could not find any stated deadline regarding when this app will be available for the customers.

Conclusion

At the first glance, Tradeo’s service resembles to the likes of eToro as it offers an integrated cloud based software solution as well as in-house brokerage service. However, Tradeo is not registered in the USA. Hence, it cannot accept US customers due to regulatory issues, where eToro can. However, Tradeo’s range of copy trading service, especially the feature rich Social WebTrader would be a close competitor of eToro’s OpenBook and Webtrader in the International market. If you are not concerned regarding the lack of regulatory oversight by western financial authorities, Tradeo could be an excellent option for your copy trading needs.